Palantir Hits $38 but Bank of America Says It's Worth $50...

Analyzing the Bank of America Upgrade for Palantir

Welcome back to DailyPalantir! On today’s newsletter, we discuss Palantir hitting $38 yesterday and Bank of America’s upgrade to $50. Let’s get into it!

Palantir touches $38

So, we hit $38 per share.

With the company's market cap nearing $85 billion and profits still under $500 million, there’s a growing debate on whether the stock is overvalued. Analysts like Raymond James downgraded Palantir from "outperform" to "market perform," suggesting caution after the stock's significant run-up this year. While not bearish, they indicated that the stock might need time to consolidate its gains and grow into its valuation before climbing higher.

The stock's valuation has expanded to about five times fiscal year 2025 sales estimates, making Palantir one of the most expensive software names out there. This reflects the massive hype surrounding the company, especially with its involvement in AI and defense technologies. The stock is up around 130% year-to-date, which has raised concerns among some analysts that it could face short-term resistance or even pullbacks if growth slows.

Despite these concerns, there is still significant excitement around Palantir’s long-term potential. Many investors, myself included, believe that Palantir’s position in AI gives it a strong future, and they’re willing to pay a premium for the stock, assuming that its potential will justify today’s elevated price. This optimism stems from the idea that Palantir could become one of the leading AI companies globally, and for long-term investors, buying at $35 or $38 might not make much of a difference if the stock is expected to climb exponentially in the years to come.

What’s driving the premium?

A key reason for Palantir’s premium valuation is its CEO, Alex Karp. His bold leadership and his ability to communicate Palantir’s long-term vision give investors confidence. Karp’s public statements, especially his critique of short sellers, show that he is fully committed to proving the skeptics wrong. This kind of leadership has resonated with investors, who believe in his ability to guide Palantir through its growth phases and market challenges.

Another reason driving Palantir’s valuation is the broader AI narrative that’s dominating markets. OpenAI, for example, is valued at $150 billion despite not being profitable. Palantir, with its deep integration in AI, is viewed similarly by many investors who believe AI is going to revolutionize industries. This belief justifies the higher valuation because Palantir’s position in the AI revolution is seen as a long-term growth driver.

For those who have held Palantir stock, the current price levels present a dilemma. While some investors are considering taking profits, others believe that this is just the beginning of Palantir’s growth story. Strategies like selling covered calls or trimming positions to lock in gains are being considered by many. However, for long-term believers, holding the stock through potential short-term volatility makes sense because they see it as a multi-year growth play with much more upside ahead. I actually spoke to some people who are really struggling with this. It’s a good problem to have, and we discussed it further in depth here about how to navigate the thought process on this.

While some may argue the stock is overvalued, I believe there’s strong justification for the premium given the company’s potential in AI, Karp’s leadership, and the market's long-term expectations. This doesn’t mean the stock can’t fall from here, but there is also momentum to the upside. I think Palantir could easily go to $30 and $45. If you are long, it doesn’t matter. If you have a short term mindset, selling calls or shares may be a strategy, but you really need to know what is your timeframe when navigating your Palantir position.

Bank of America Full Upgrade to $50

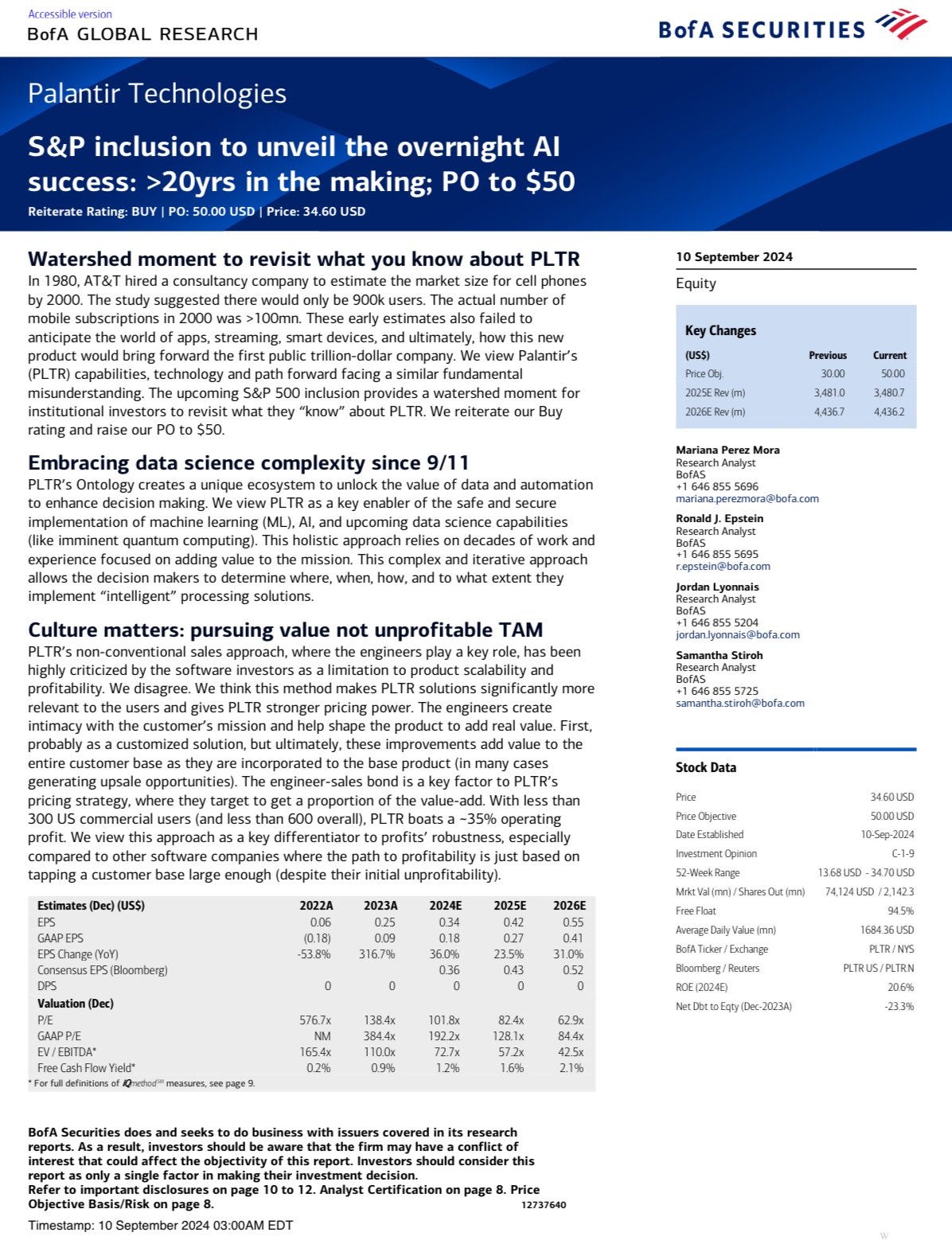

Before we get into the $50 upgrade, here is the full report:

Palantir's Bank of America $50 Upgrade

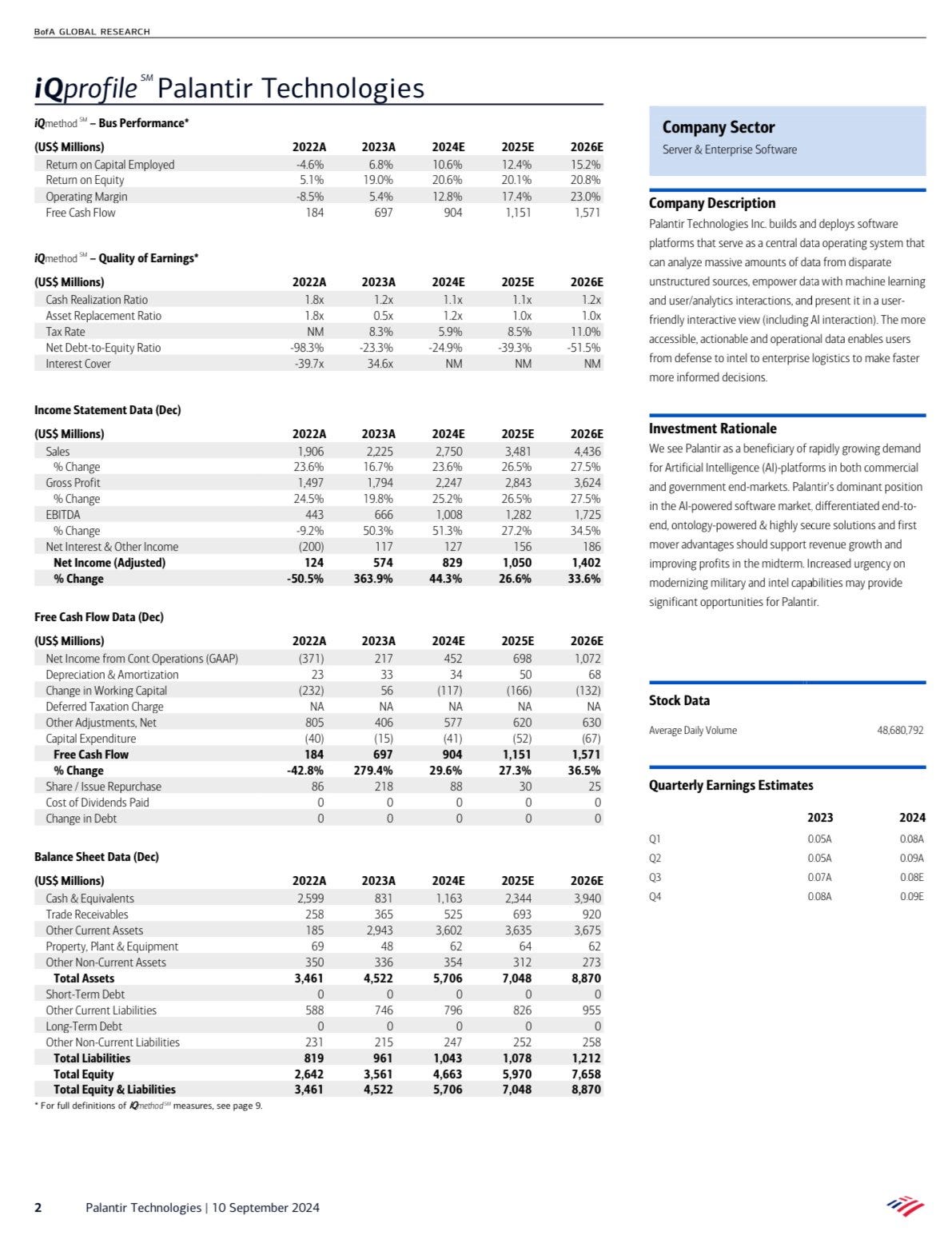

Bank of America recently raised its price target for Palantir to $50, signaling growing institutional confidence in the company’s future potential. Mariana Perez, the lead analyst behind the upgrade, has been bullish on Palantir for some time and has continued to increase her target as the company demonstrates strength in AI and defense. Jumping from $30 to $50 is a bold move, but it reflects the belief that Palantir is poised for significant growth, particularly with its AI products becoming more entrenched across industries.

A key factor behind this upgrade is the success of Palantir’s AIP boot camps. These boot camps, where engineers work directly with customers to implement AI solutions, are seen as a major competitive advantage. Perez believes this strategy gives Palantir strong pricing power and creates deep, lasting customer relationships. By focusing on highly customized solutions, Palantir can deliver more value than traditional software companies, which is why their customers stick around for the long haul.

Palantir’s position as a leader in AI and machine learning is another reason Bank of America is so bullish. Perez highlights that Palantir isn’t just playing in today’s AI landscape but is also well-positioned to be a key player in future technologies like quantum computing. This forward-looking view of Palantir's potential in advanced technologies adds to the excitement and justifies a higher price target.

Operating margins are also a key part of Bank of America’s confidence. Perez expects Palantir’s margins to continue expanding as more companies adopt its AI solutions, which will enhance profitability. As Palantir scales, its operating margins could become even more attractive to investors looking for growth in both revenue and profit, which in turn would support the stock price increasing to $50.

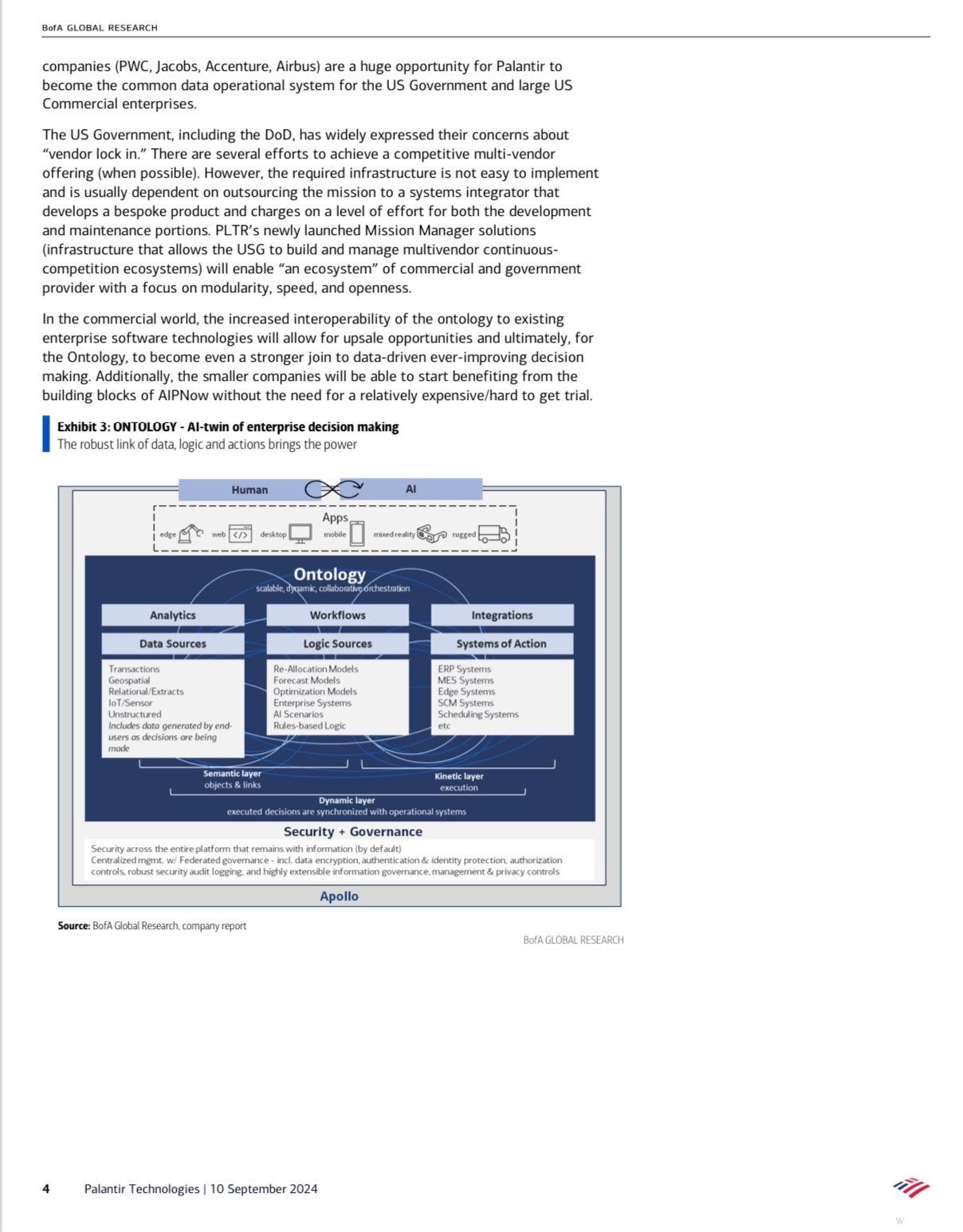

Bank of America’s upgrade is rooted in the broader AI narrative. As the AI revolution continues to gain momentum, Palantir’s unique positioning could drive further growth. Perez specifically points to the company’s ontology, which organizes data and makes AI usable for enterprises, as Palantir’s secret weapon. This technology could be the key that allows Palantir to maintain its competitive edge in a rapidly evolving AI landscape.

While some might argue that Palantir’s valuation is already stretched, Bank of America’s upgrade isn’t solely based on numbers—it’s a qualitative analysis of the company’s trajectory. Perez is essentially betting that Palantir will grow into its valuation over the next few years as its AI solutions continue to prove their worth. This long-term perspective aligns with the belief that Palantir is more than just a software company—it’s at the forefront of a technological transformation.

The $50 price target from Bank of America is a strong endorsement of Palantir’s future. Mariana Perez’s analysis reinforces the company’s strengths in AI, its powerful customer relationships, and its potential for significant operating margin growth. This upgrade shows that institutional investors are increasingly recognizing Palantir’s unique value proposition in AI and defense, which could lead to substantial growth in the near future.

Bank of America AIPCon 5 Recap

Here is Bank of America’s AIPCon recap:

Bank of America’s recap of Palantir’s AIPCon 5 highlighted several important themes, including the significance of Palantir’s inclusion in the S&P 500 and the company’s long-term growth potential. CEO Alex Karp kicked off the event by emphasizing the importance of this milestone, not just for prestige but for what it means for the company’s credibility in the market. Karp made it clear that Palantir’s success is built on a combination of powerful products, strong values, and a world-class team—all of which are driving the company’s continued growth.

One of the major takeaways from AIPCon 5, according to Bank of America, was the reaffirmation of Karp’s belief that Palantir could be ten times larger than it is today. This bold vision is central to Karp’s strategy, and it’s something that Bank of America appears to buy into. They noted that Palantir’s inclusion in the S&P 500 opens the door for more institutional investors to take a closer look at the company, which could drive more capital into Palantir and accelerate its growth.

The customer presentations at AIPCon 5 were also key in convincing Bank of America that Palantir is delivering real, tangible results for its clients. The bank noted that Palantir’s work with major partners across healthcare, defense, energy, and other industries is driving material improvements for these organizations. This success is not only strengthening Palantir’s business but also creating a stronger foundation for future growth.

Another highlight from AIPCon was Palantir’s ontology. Karp explained that the ontology is what makes AI truly useful for businesses, as it structures and organizes data in a way that unlocks value. Bank of America sees this as a major differentiator for Palantir, positioning the company to dominate the AI space as more industries adopt AI technologies. The ontology is key to making AI operational in complex environments, and it’s a competitive advantage that few other companies can match.

Bank of America was also impressed by Palantir’s boot camp strategy. These boot camps, where Palantir engineers work closely with customers to implement solutions, are seen as a unique way to build deep customer relationships. This hands-on approach not only ensures that customers see real value from Palantir’s products but also creates long-term loyalty, which translates into recurring revenue and more upselling opportunities over time. Another key takeaway from AIPCon is the broader theme of Palantir’s role in the AI revolution. Bank of America sees Palantir as uniquely positioned to capitalize on the growing demand for AI solutions, especially in industries that require secure and reliable data management. The fact that Palantir is trusted by governments and large corporations speaks volumes about the company’s capabilities and its potential for continued growth.

In summary, Bank of America’s recap of AIPCon 5 reinforces their bullish outlook on Palantir. The event highlighted the company’s key strengths, including its S&P 500 inclusion, customer success stories, and the power of its ontology to drive AI adoption. Bank of America believes Palantir is poised for significant growth, supported by its unique technology, deep customer relationships, and ability to deliver real-world results in critical industries.

Overall, it really feels that Bank of America is starting to get more bullish on Palantir as one of their core technology picks. The bootcamp strategy, the ontology, and the customer focus is beginning to solidify their thesis and it’s nice to see an institutional analyst care more about Palantir’s growth prospects and potential.

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!