Palantir Gets 3 New Defense Contracts

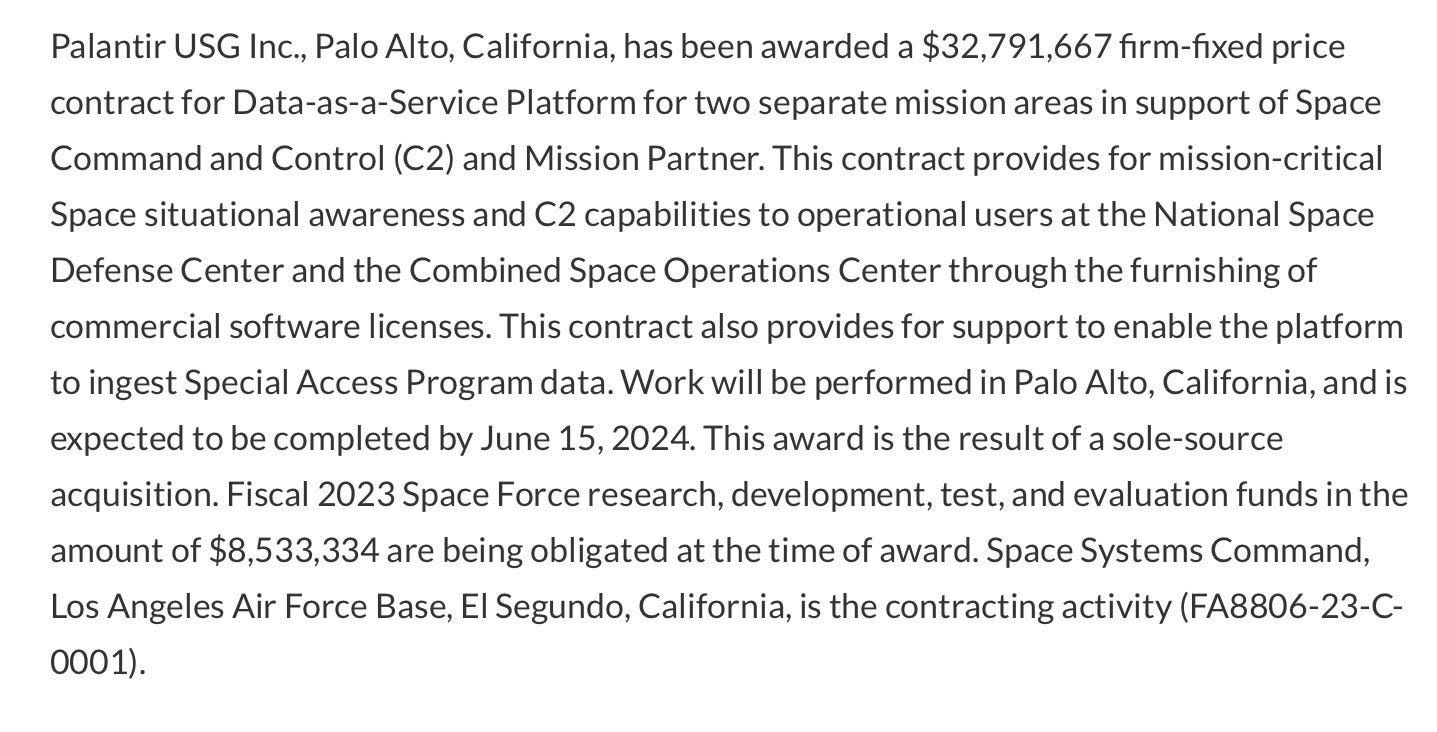

Palantir has just been awarded 3 Defense contracts totaling $100,454,815. The Department of Defense announced a slew of contracts today going to various defense contractors — Palantir won 3 in regards to the Aerospace Defense Command, Space Command, and the Headquarters Air Force. All were contracts for Data-As-A-Service Platforms.

All of these contracts expire in June 2024. That's 100M, for 1 year. Not spread out over 5 - but in 1 year. 100M in rev added to the top line. All contracts also included: “This award is the result of a sole source acquisition.” Single source procurement is when there are multiple vendors to choose from but you decide to go with one of them. Sole source refers to a situation when another company wasn’t even bidding for the contracts because no one else was capable to provide the services. Palantir was the only company available, for these 3 contracts, to even provide the data analytic services required. There was no competition.

Now, when I debated a Palantir bear -- his argument around Palantir winning defense contracts was, "So what! Consulting firms win defense contracts all the time. Look at Booz Allen Hamilton!" Okay...let's take a look at them. Today the DoD awarded 100M to Palantir for 3 defense contracts, and one to none other than BAH.

Booz Allen Hamilton won a contract for 20M to do... "program management, technology security support, food services support, and facilities management support." None of this has software margins. Program management support...are you kidding me? Vital, important work, but absolutely SERVICES-based work, work for a services, or consulting firm... Palantir's 3 contracts are rooted in, "providing for automatic data ingestion with data across the Department of the Air Force that continually push personnel, equipment, planning, health, and other readiness data sources into their common data foundation. This readiness information is a critical component of HAF-wide decision-making and data analysis."

Palantir's software, with software margins, is not just providing program management support, it's establishing an entire data analytics platform for agencies to take siloed data, attach them to a common data foundation (ontology) and then make decisions at scale. One is true consulting firm, that will win defense contracts, the other will become America's first Software Prime.

A Different Take on The Palantir SPACS…

Most people say these SPAC investments we're failures. And, well, financially...most of these investments have gone to zero. For those that didn't know, Palantir invested a few hundred-million towards the latter half of 2020 into SPACs, which ended up being very speculative bets. Most of these investments have gone to zero. The investments are largely behind them now and don't affect the balance sheet, but investors looking into the company always see it as a major red flag.

Why did they make these investments in the first place if most of those SPACs were likely just zero-interest-rate phenomena? While most people have theorized about the SPAC investments as a failure for a long time, I think there is one secret reason very few people have come across that ultimately pulled the trigger for Palantir to make the investment. One website has all the answers -- caedmongroup dot com Caedmon is Palantir CEO Alex Karp's middle name. After researching a bit more about Karp, I found out that his grandfather left him a large inheritance.

He took that money and started cademongroup, and as a result, began investing in startups. He was highly successful and earned a reputation around London and NYC (where he had offices) as someone who could find eccentric companies at their earliest stage and hit it big by investing in them. From a Forbes 2013 piece on Karp: "Some high-net-worth individuals heard that "this crazy dude was good at investing" and began to seek his services, he says. To manage their money he set up the London-based Caedmon Group, a reference to Karp's middle name, the same as the first known English-language poet." It is my hypothesis that Karp's past as a capital allocator/VC, and actually being successful at it to the point where others would give him their money to manage, is why he may have spearheaded the push to invest in SPACS. In fact, I think Peter Thiel likely chose Karp to be the CEO because Palantir, by nature, is a contrarian company.

A VC takes many contrarian bets to find the 50-100x. Peter Thiel is one of the greatest VC's of all time, and he was probably impressed by the philosophical and money-management skills by Alex Karp -- it's hard to find a philosopher who can also allocate capital into very risky plays but still make it big. A venture capitalist by nature is going to maybe hit one good company for every 100. It's just the game of VC. Karp took his success as a VC and brought it over to the SPACS.

Now, unfortunately, those investments just didn't pan out as the market and overall macro flipped. HOWEVER -- this is the beauty in investing with a founder led company. Any normal operator would likely have never made these investments, and in the short term, it would look great on the balance sheet.

The problem is, investing in a normal operator doesn't give you transformational companies or returns. When investing in founders, you deal with the good and the bad, hoping the good outweighs the bad in the long term. If Karp was the brains behind the SPAC investments, it likely was because he trusted his gut instincts enough to make more speculative bets on public companies just like he did in the VC world.

While many did not work, I'd argue that I want my founder-CEO to take these risks any time of the day. Bezos launched an Amazon phone. Zucks launched the Libra coin. All failed. Founders take risks regardless of what anyone thinks, including shareholders, because the know that if they don't innovate -- they die. While the SPACs may be a failure on the balance sheet, (some of them like $LILM, $DCFC, $BSKY I think actually having a chance to do well over the coming years) the risk taking associated with a strategy like this is something you'd only get from a founder with the insight to see what really innovative companies could do with their software.

If we accept all the good that comes with Karp and his foundational philosophy around data governance, which is the single reason BoA gave Palantir a price target increase to $18 yesterday, then we've got to accept some of the bad. Sometimes the bad is a founder believing they can take their past, private investing philosophy and bring it to the public markets.

Regardless, I want my Founder-CEO taking risks. In the long term, I don't want to be investing in someone ordinary, I want to invest in someone extraordinary, and I'll deal with all the good and bad that comes with investing in that visionary founder.

The Mainstream Media Is Noticing Palantir

More and more mainstream networks are started to cover Palantir. As the AI rave becomes more important, larger media networks are looking to improve their AI coverage, and as they do research, Palantir just happens to come up as one of the core AI players…

You can watch my analysis on this here.

That’s it for today - thank you for reading!