Welcome back to DailyPalantir! On today’s newsletter, we’ll discuss Alex Karp’s latest comments for short sellers, new price targets, and how we should look at valuing a stock via P/E.

So, since the last newsletter we’ve had a pretty huge Alex Karp interview. The interview was, in my opinion, a top 3 appearance by Karp because of his ability to explain why clients are choosing Palantir for their AI needs over the competition.

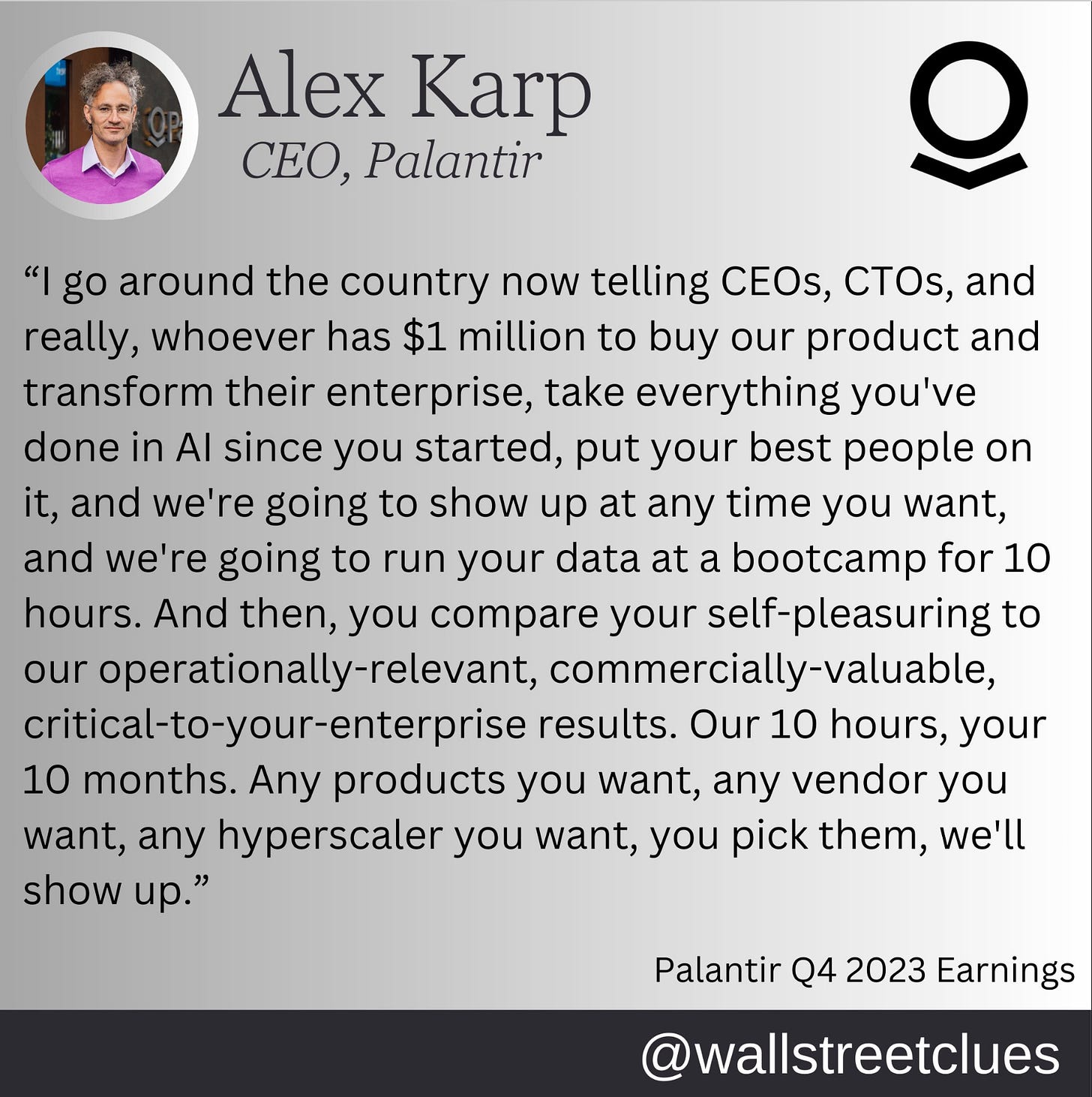

Another reason it was one of his best experiences was because of how authentic he was. The quote that got everyone talking was this:

Now, I thought this was hilarious. You can tell Karp didn’t rehearse that line about coke — the reporter asked him about short sellers and he randomly decided to go on this rant about why short sellers, specifically ones betting against Palantir, were high out of their minds.

It felt authentic and real, especially because you could tell how passionate Karp was about people betting against his company — not all short selling is bad, but a CEO should take it personally if his company is trying to defend the United States and then random short sellers want to tear it down. Shorting great American companies was the crux of why Karp even said what he said. Also, I liked that he got this aggressive — given the numbers Palantir has been putting up, you are allowed to talk with a bit more fun as a CEO given you are executing. If you make some headlines because you use your vernacular in a way that raises eyebrows, you are actually doing what you are supposed to be doing as a CEO — getting people to care about your company.

Some other notable quotes from Karp:

The interview really highlighted how strong Karp feels about Palantir’s position in the broader AI market — he knows they can capitalize on it, they just need to continue executing and more companies will become aware of what Palantir really has to offer.

New Price Target — $37

Palantir got a price target this week from Brian Stutland, portfolio manager at Equity Armor Investments, for $37. This is the highest price target on the street and is mainly because of their government business accelerating and demand from the broader market around AI. While this is a great price target, and higher than Wedbush ($35) and BoA ($28), it got me thinking about what $37 would entail.

Palantir’s market cap would be closer to $80B. With our current growth at 20% YoY, this probably would be stretched. I do think $30 by the end of the year is likely — but getting to $37 would require increasing top line growth to 23-24% and having more of our net income come from business operations vs. treasury income.

Is $37 possible? Yes, but we would need to put up closer to $2.8B of revenue vs the guidance of $2.65B.

Palantir vs. Apple

This was a great point by Arny comparing Apple to Palantir when Apple was trading at a 320x Price to Earnings.

One of the main bear cases people point to around Palantir’s valuation is the 260 P/E and how it’s absurd to pay that much.

Arny brings up a good point here…

His argument is that buying Apple in 2004 at an “overvalued” P/E led to 78,000% in returns.

The reason for this is because eventually Apple was able to grow into the valuation and the P/E started to make sense. Amazon in 2014 is another example of a company with a large P/E but eventually made sense.

At the time, people said Apple or Amazon were overvalued and investors paying for those stocks had no understanding of valuations. The problem is, exceptional companies that have a growth story behind them and a PLAN on how to execute eventually will, and then their valuation looks easily justified as the grow into it.

One thing we know Palantir is doing well at — bootcamps.

Bootcamps really made a company that doesn’t do sales innovate in sales. Karp has said they have 20x’ed pilots from 2022. As bootcamps grow, so will customer count. Just amazes me that a company with its back against the wall, with the highest rates since 1980, figured out how to innovate and push through in SALES when their DNA is in product.

More bootcamps means more customers = more revenue, which will be key for Palantir as they begin to grow into their valuation, decrease their P/E, and show they were a company worth betting on because they focused more on providing value to clients than simply monetizing them.

That’s it for today - thank you for reading & I’ll see you tomorrow in your inbox!