Alright, I’m back!

Last time I sent out a post was October 18th, so it’s been almost 2 months.

I haven’t stopped covering Palantir since then, I just was not able to get out the newsletter every day, but…

Newsletter has been on a hiatus for the past month for two reasons: 1.) Personal life had some issues come up on the family side & 2.) We’ve been working on a product, specifically for Palantir investors, that I think all of you will love.

I (Amit) write these newsletters myself, not ChatGPT, so I’ve been trying to figure out how to get the newsletter along with my main YouTube content out. It’s been very challenging, but I’ve figured it out how to actually make sure these come out daily, so you can expect these to come 8PM EST every day. I might change the time in the future, but for now that’s the best slot - hopefully an easy time to read for everyone after they are home from work.

The problem is, I love talking - so YouTube is really fun for me. I am not the biggest fan of writing, but the newsletter is very important to me. I hate ChatGPT written content for newsletters, so I just need the time to be able to construct a meaningful write up of the day’s news myself every day, which I believe I have figured out how to do — it will be similar to what I do every day now on YouTube, putting out one episode wrapping up subjects for the day.

I also got an idea, a pretty interesting one, last month.

The idea centered around how to create one of the best research tools for Palantir investors that could leverage the content I’ve been building.

I’m biased, but I think when we launch it, every single person reading this will pay the $4-$5 a month it costs to access it. I am not kidding. You will pay the $5 because the opportunity cost of not paying it will be too high.

In early beta testing, it is that good.

Really excited to show you all — launch date is Jan 2024. What I can say: this tool will make you a better, more informed investor of Palantir, and in the long run hopefully can serve you to aid your convictions and knowledge around the company leading to larger returns IF the company can perform over the next decade.

No, it’s not some private community/patreon/exclusive content, etc. — I honestly have become tired of those offers because they just aren’t scaleable and there’s no tech element to them to provide outsized value.

I think I have the solution. And it can scale to millions of people. And it will be so cheap, I don’t think there will even be a second of hesitation to purchase it once it launches.

I think you’ll like it.

Alright, so since I’ve been gone…

Palantir put up some amazing Q3 earning numbers

The stock has rallied from $15 to $21.85, reaching 52 week highs

AI and it’s future has gotten more investors globally excited

Over the next few newsletters I’ll go deeper into all these topics. There is ALOT to discuss, but today I want to mainly focus on what has allowed the stock price to go higher.

First, let’s look at the core things from earnings that mattered;

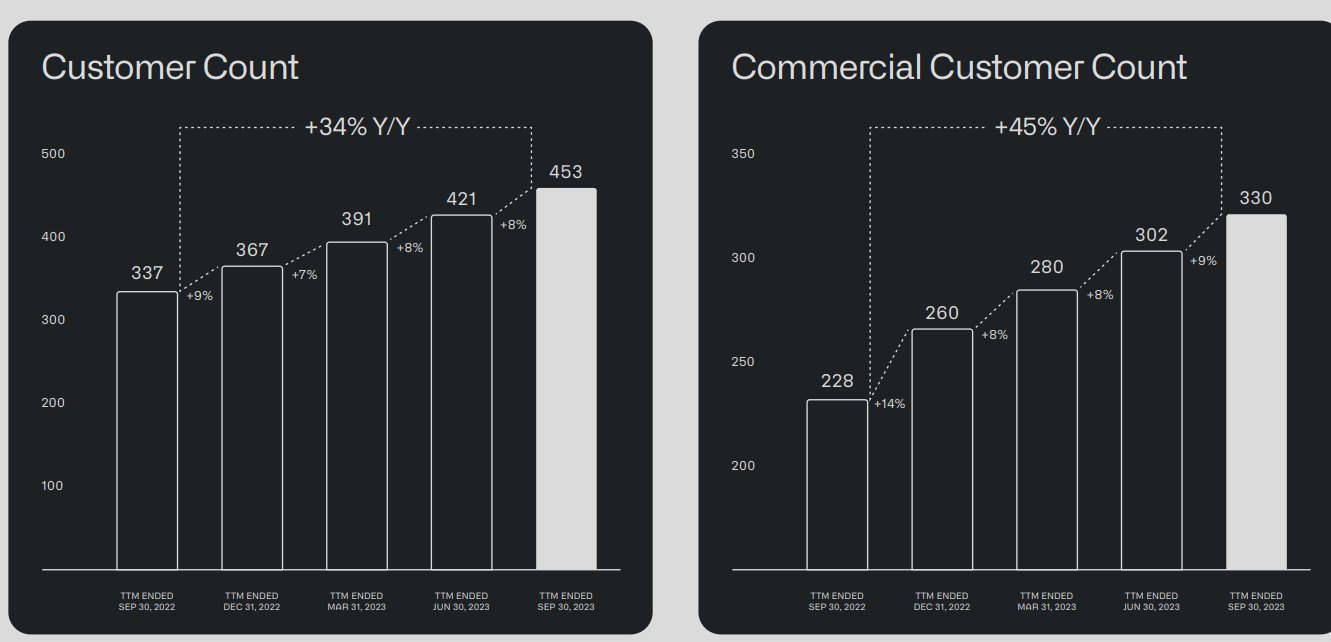

Customer count is the only metric I truly cared about going into earnings. We continued with GAAP profitability and increased revenue growth from 13% to 17% — not good but getting better.

However, customer count, especially commercial customer count, is growing rapidly. The government part of Palantir’s business still makes up a majority of the revenue, so the advanced growth in commercial is signaling to investors that the company is on a trajectory to truly expand into what all of us think they can become — the most important software company in the world.

We know the government business is sticky and will always be there…so how does Palantir plan to actually capture the entire market?

Bootcamps.

Shyam Sankar, CTO, said on the earnings call that they will be doing 70 bootcamps in the month of November alone, which is more than they did in all of 2022.

The bootcamp Go-To-Market strategy is not original, but the way Palantir is implementing it is truly unique.

It’s not just a slideshow or demos of how the product will work, it’s deploying engineers into bootcamps to work with customer data to showcase how those clients can actually operationalize their data within Palantir’s products. Customers are walking away with actual use cases, something they can show decision makers at their respective companies, and likely converting better for Palantir than any other sales tactic they have ever done.

One of the reasons I’m particularly bullish on bootcamps is because it’s a product-first GTM strategy for a product-first company. Alex Karp has openly admitted that Palantir does not have, nor has ever had, a good sales culture because sales is not in their DNA — product is.

It only makes sense then that the sales strategy is all about showing the product vs trying to sell an executive a product over a fancy dinner. I could not be happier with how management is executing on this — and if they can scale their bootcamp growth at 10-20% MoM, their conversions to customers using Foundry and AIP will also scale, and we will see the growth we are looking for.

Again, the product can sell itself, but it needs a demonstration for the “aha” moment from the customer. The unit economics on bootcamps may prove to be one of the best GTM strategies in enterprise SaaS.

WE GOT THE NHS DEAL

I’ll be discussing this more in depth over the coming weeks - but this was a really big deal.

Now the specifics on the deal were a bit different than what we thought - Palantir is getting $480m vs $600M and sharing the deal with a few other consulting firms - but all of that is beside the point — WE GOT THE DEAL.

We as a community have followed this NHS contract saga for 2 years. Finding new pilot programs.

Looking at who was being hired in different roles. Fighting off the propaganda from advocacy “nonprofits” that told lies about Palantir. All for today - Palantir being awarded the NHS Deal. In my opinion, I couldn’t care less about the monetary value of the deal today.

Think a decade from now when Palantir has fixed a broken NHS that could not be fixed for the past 3 decades…what that means for all socialized healthcare systems around the world that could bring in Palantir and not compromise their values BECAUSE OF Palantir’s technology.

Money truly means nothing for this deal. Healthcare is about saving lives. There will always be massive spend in healthcare — trillions yearly. Not many companies will manage an entire country’s entire healthcare system. Palantir is one of the lone companies that will embark on fixing the NHS.

This deal will have so many implications for the next decade to tackle the $4T industry that is healthcare…and we are just getting started.

THE STOCK HAS RALLIED.

Palantir is up 34% in the past 3 months — a very strong Q3 earnings got the market excited, and once they were excited, more momentum started to build.

Again, I’ll be analyzing why this happened over the next few newsletters — but what is important to realize is that the narrative around Palantir, especially on the institutional side, is changing.

I spoke to Dan Ives yesterday on my channel, and he indicated that conversations he’s had with larger institutional investors indicated that they believed Palantir was part of most organizational planning when it came to who they wanted to allocate their AI spend to going into 2024.

AI is not going anywhere, and the enterprise is just starting to realize how much they can gain by investing in it. Palantir is becoming synonymous with the concept of AI — especially given how they have marketed their AIP platform.

On top of that, other SaaS companies are starting to command a premium - MSFT, SNOW, DDOG, CRWD are being respected by the market for their growth and potential.

Although Palantir is not growing as fast as those companies — they did do the one thing they needed to do: get GAAP profitable for 4 quarters.

As a result, fund managers likely have been buying Palantir for exposure before they get included into the S&P 500 — another major catalyst propelling Palantir’s stock.

I’m sorry I’ve been gone from the newsletter for the past 2 month, but…

we are…

just getting started.

Everyday 8PM EST - excited to be back!

That’s it for today - see you tomorrow!