Welcome back to DailyPalantir! Palantir’s Q4 earnings are in 5 days, so it’s time to discuss what are the most important things retail investors care about — we’ll be analyzing key shareholder questions and what I would like to see answered on the call. Let’s get into it!

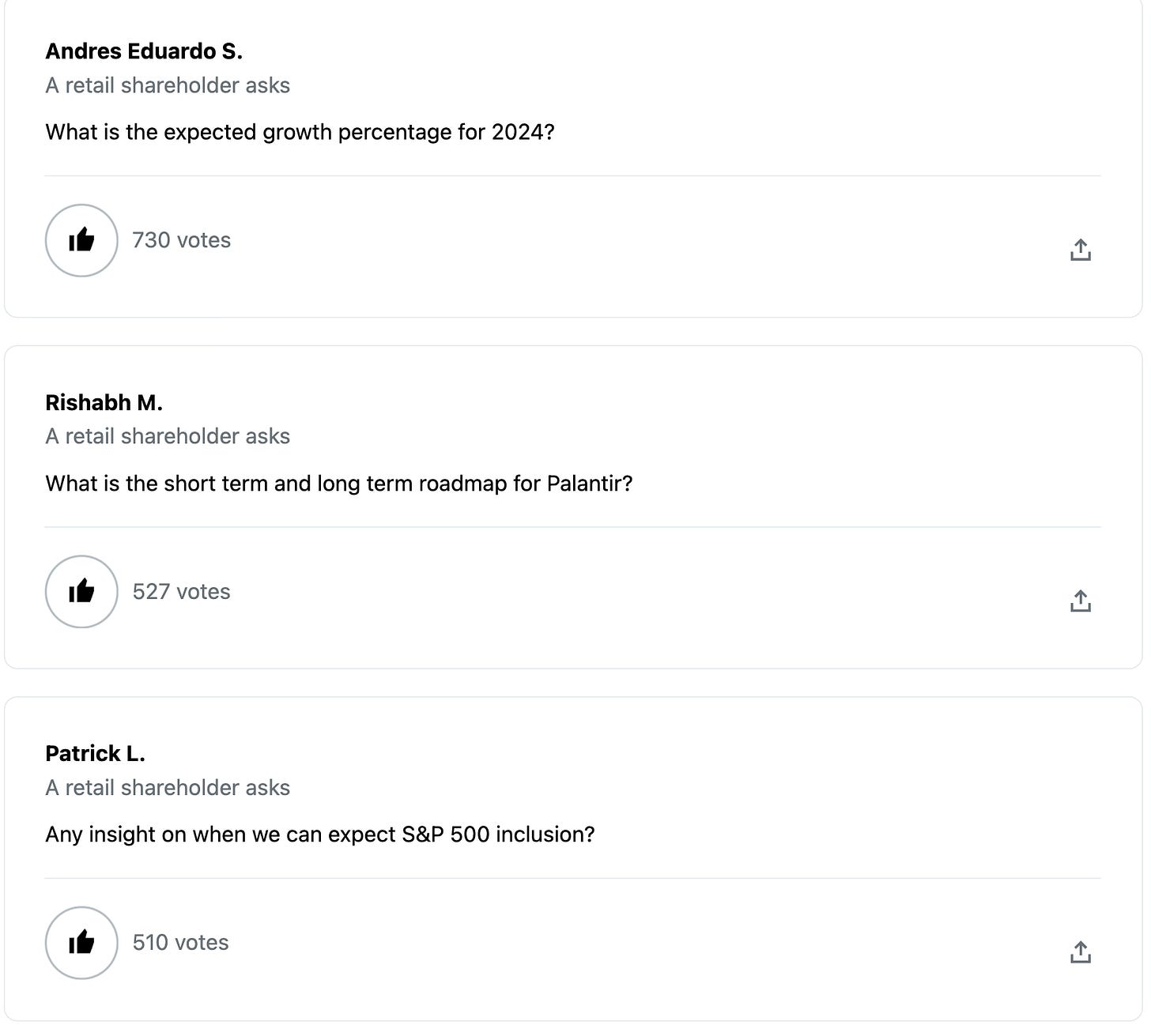

Growth, Long Term, S&P 500 Questions

On growth — Palantir will have to give guidance in the 20%+ range for the stock to not get destroyed. I really don’t think it’ll come in below 20%, but I could be wrong.

If we end up getting 25-30%, then the stock is going to be in a position where it can actually ride the AI trend because it is growing. Microsoft reported earnings today and is showing how their core AI subscription, co-pilot, is quite literally adding billions of dollars to their top line every year that will eventually come to the bottom line. Azure AI crowd brought in $25B this quarter. The market will reward Palantir with AI exposure, especially with investors who want a cheaper name by market cap on paper, but they need to show the growth in order to get there.

On short term & long term roadmap — I don’t think this is the best question because management has been pretty clear about what they are doing and how they plan to grow over the future. However, I would like them to address short term headwinds they see in the SaaS space. For example, are they seeing more clients willing to spend on products even in a high interest rate environment. What factors are leading to fortune 500 clients to actually pay more or less, impacting their net dollar retention?

I’d also really like to understand what assumptions Palantir is putting into the business’s growth in the context of the Fed — for example, if Palantir guides for 20% growth, is it with the assumption that we will see 3-4 rate cuts? Rate cuts make it significantly easier for businesses with debt to pay for the cost of capital, meaning they have some money that frees up for procuring software like Palantir’s. That’s another reason the company chose to focus on GAAP profits over growth, they saw that it would be harder to get businesses to pay a hefty sum in a high rate environment, but they could focus on being more fiscally responsibly.

I’d like to know the short term headwinds and long term tailwinds the company sees within the coming 2 years for the core business itself.

On S&P Inclusion — I don’t think Palantir will have a definitive answer to this. They are well aware of what they needed to do in order to ensure they would confirm their spot — 4 quarters of GAAP profits were the hardest and most important thing to get done, and they did it.

Now, it is up to the committee to go through all the eligible companies and eventually make the decision. Last December was simply too early for them to get in since companies like Uber and Lululemon had been waiting for a while. I imagine we’d see a decision by mid 2024 to allow them in, which would be a massive catalyst, but not a catalyst management can give a definitive answer on.

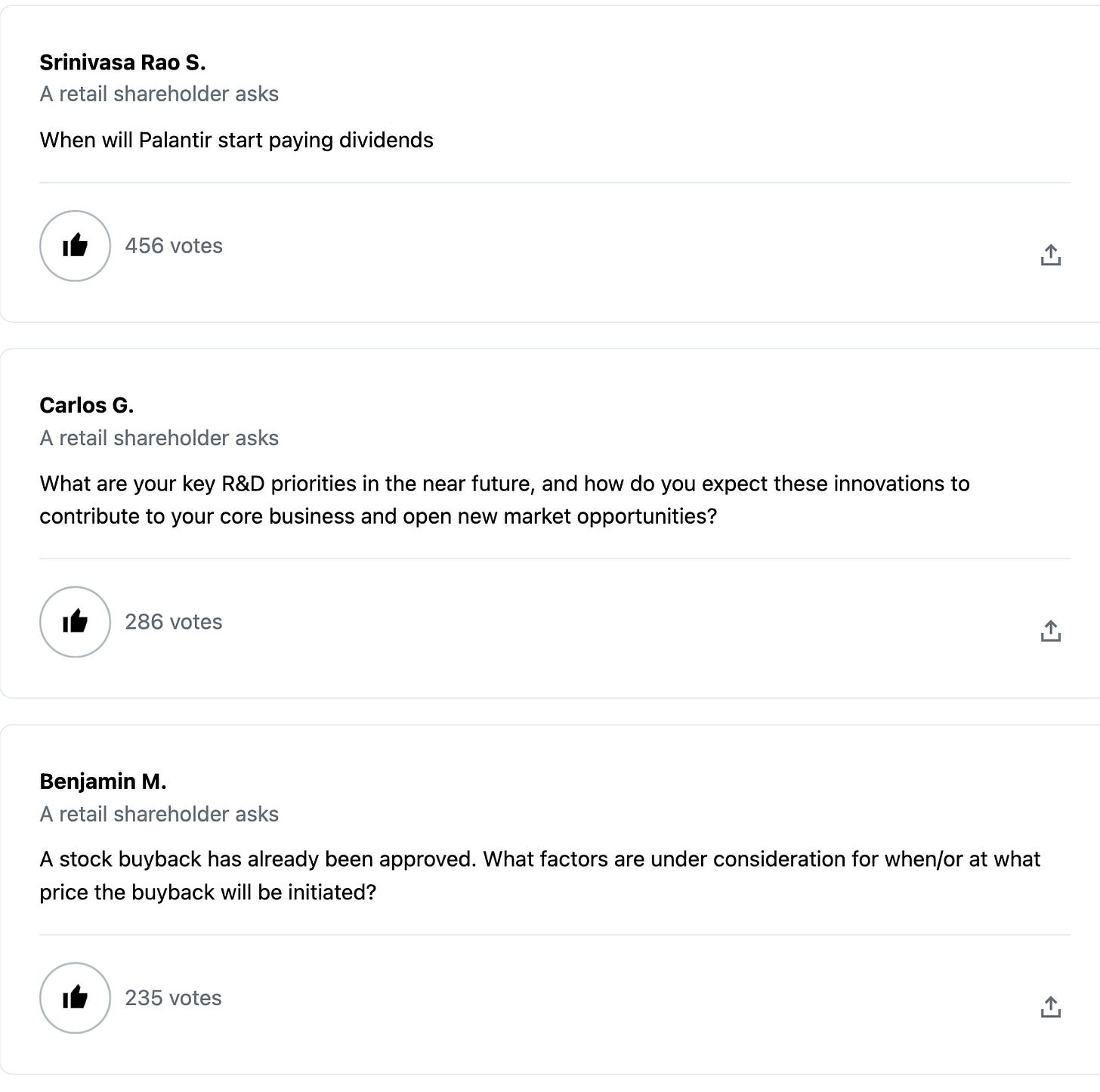

Dividends, R&D, Buyback Questions

On dividends, Palantir should NOT be paying a dividend to shareholders. It would be a major red flag for a growth stock to start taking money and giving it back to shareholders as a reward for owning the stock — the stock itself should go up and that will be the reward. That is why we are all taking so much risk investing in an individual equity over an ETF. Many shareholders think dividends are just the company being benevolent to their investors. This could not be further from the truth. Dividends are a way to justify owning a company that is barely growing — without it, most investors wouldn’t touch banks, REITSs, etc.

With Palantir, we are looking for massive growth, which will result in share appreciation, not compensation for owning the shares while the share prices are flat.

On R&D — this is a really important question. We know that Palantir is highly innovative, they came up with AIP within a month of ChatGPT going mainstream and then pivoted the entire company onto the model. They haven’t done an external acquisition in 8 years. Snowflake, on the other hand, did 4 acquisitions last year alone.

I would love to hear some hints of what management is working on via R&D in the form of new product offerings, whether in the commercial or public sector, because we all know they are working on things behind the scenes. Even Alex Karp has hinted in numerous interviews about products the world doesn’t know about yet that Palantir is constantly iterating on. This is a company that prides itself on being 5 years ahead of every other software company, so it would be really exciting to get some clarity on product categories or ideas they feel are worth pursuing.

On buybacks — my belief is that Palantir should not do a buyback yet. A buyback would artificially be Palantir signaling to investors where they believe the stock should be, setting somewhat of a floor to the stock ($1B in buybacks is not enough to set a floor, but it would be a signal to investors for what price MGMT would believe Palantir is cheap at).

The problem is, we need to remain GAAP profitable. It is likely that in Q4 we will have meaningful income from operations so we won’t need net interest income (the $3B we could put in short term treasuries) to generate profits in order to ensure we remain GAAP profitable — however, we don’t want to see EPS go down. If we buy back our stock, it doesn’t meaningfully reduce the float. It’s only $1B.

If we use that $1B and make 5% on it…it really helps us maintain an earnings per share that is stable and potential growing.

I think by mid 2024, when the company is in a much more stable spot due to AIP scaling, that would be the time to deploy buybacks. Right now, the stock could fall easily for a host of reasons, and maybe if it gets low enough a buyback would make sense, but likely not at these prices.

Government Questions

Okay — so the most important question I would have as a shareholder on the call would be around the government business. I think it’s very important for Palantir to address this — is the US government business actually suffering due to competition?

Is 2024 going to be a year where we see spend go down? Do open source vendors have an easier time selling? Whether the news is good or bad, I would like to know.

Second, I really want to understand if NATO countries have a broader appetite to begin spending on defense. We’ve seen what has happened with Ukraine/Russia and Israel/Hamas — if there was any time for NATO countries to step up defense spend, it would be now.

Palantir’s CEO Alex Karp has met with heads of Estonia, Finland, Lithuania, and more — are those meetings turning into deals? International government growth has not gone well over the past 2 years. One of the most important questions to me would be around what the company believes NATO countries will need in order to up their spend and how they plan to bring Gotham to those countries during this time.

I don’t know if there would be a better time than now, given everything that is going on, to convince these countries that they massively need this product. NATO itself is a $100B opportunity given the sheer amount of money they can spend per year on defense. I personally think this is a major avenue for growth and would like to see management give some clarity on how they think of this part of their business.

In terms of TITAN — we will know by March, but it would also be nice to see some clarity on this and if management believes this deal is going to happen. It would be approximately $1.5B over 5 years and they would share that money with Anduril.

Dan Ives Interview

Dan Ives stopped by on the channel yesterday — if you’d like to watch him discuss his thoughts on Tesla, Microsoft/Apple, and Palantir — you can here.

That’s it for today - thank you for reading and I’ll see you tomorrow in your inbox!