Palantir Gets A Downgrade & Meets A Familiar Friend

Analyzing JD Vance's new bid for VP and what it means for Palantir

Welcome back to Daily Palantir! On today’s newsletter, we discuss the downgrade to $22 that Palantir got today and go deep into Donald Trump’s latest VP pick. Let’s get into it!

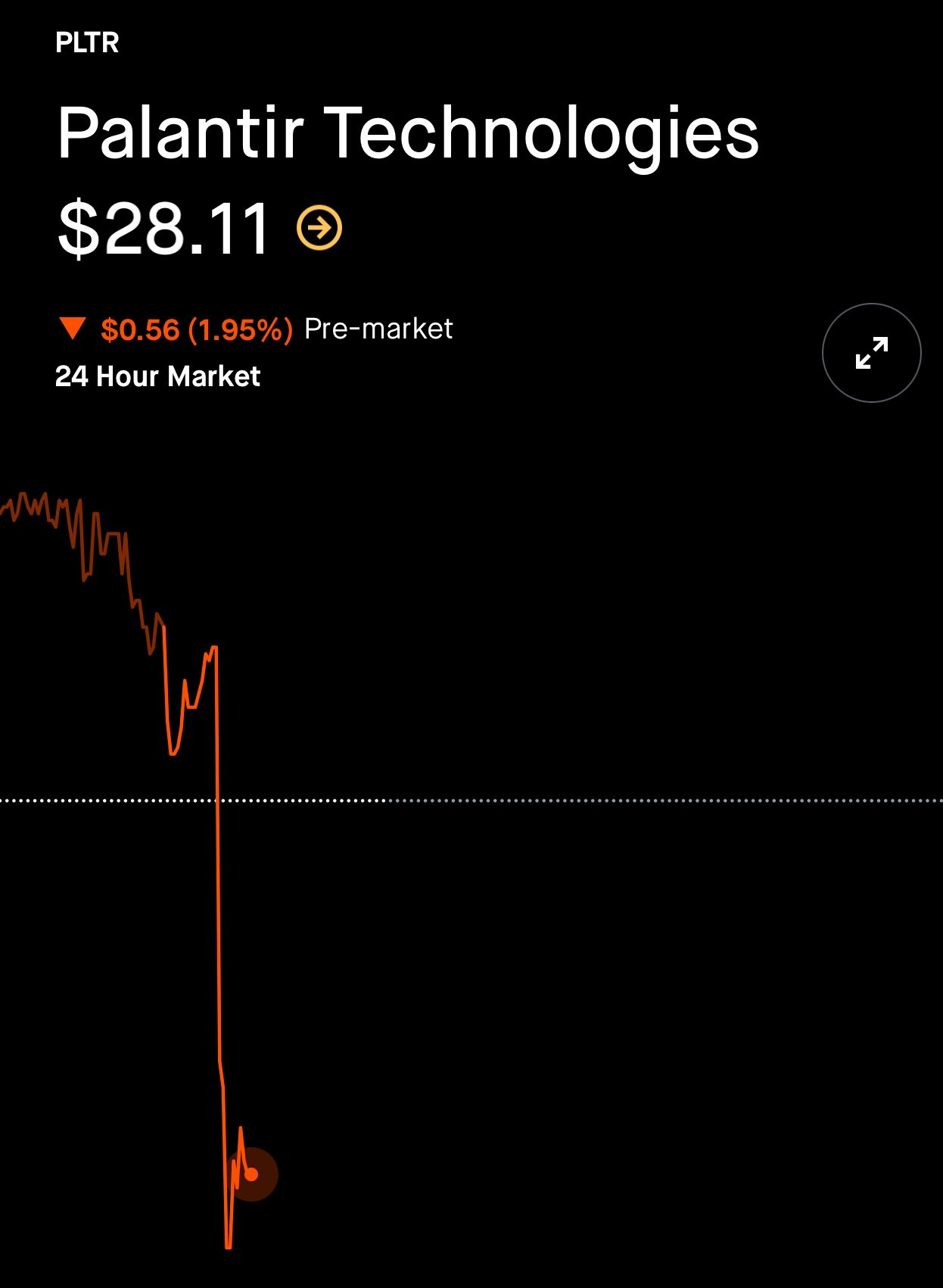

Palantir Downgrade

Palantir was down 2% in the pre markets with a downgrade coming from Mizuho to Underperform from Neutral.

They did increase their PT from $21 to $22.

Analyst comments: “While Palantir has performed generally well in recent quarters, we remain concerned by the lack of visibility into its business. Some of the beats have been lower quality, and we have limited confidence in the company’s ability to deliver consistently strong results. Primarily, following the significant 67% rise in shares year-to-date, it is increasingly difficult to justify Palantir’s high multiple (21x CY25E revenue) that, in our view, likely already discounts significant acceleration versus our/consensus expectations for 20-21% revenue growth.”

My Thoughts

The analyst's reasoning was twofold: qualitative concerns about the company's visibility and consistency in delivering strong results, and quantitative concerns about the stock's high multiple following a significant rise in shares year-to-date.

Mizuho's qualitative analysis expressed skepticism about Palantir's ability to consistently perform well, citing lower quality earnings beats and limited confidence in the company's management. While subjective, this viewpoint is not uncommon among analysts who lack confidence in a company's future performance. Many analysts simply can’t get behind the valuation. In contrast, analysts like Mariana from Bank of America, who reaffirmed a $28 price target 2 weeks ago, provide a more in-depth qualitative analysis that supports Palantir's valuation. I talked about that here.

The quantitative aspect of Mizuho's downgrade focuses on the stock's high valuation following a 67% increase in shares year-to-date. They argue that the current valuation likely already factors in significant revenue growth acceleration, making it difficult to justify further price increases. This perspective is more straightforward, as it relies on financial metrics and models to determine whether the stock is overvalued. While I don’t agree with the qualitative reasons Mizhuo downgraded Palantir because they don’t actually understand the business, I can get why they think it is running too quick and overvalued. However, it really comes down to what the market is willing to pay and how much premium they want to pay for future growth, and the market showed they were willing to buy the dip today.

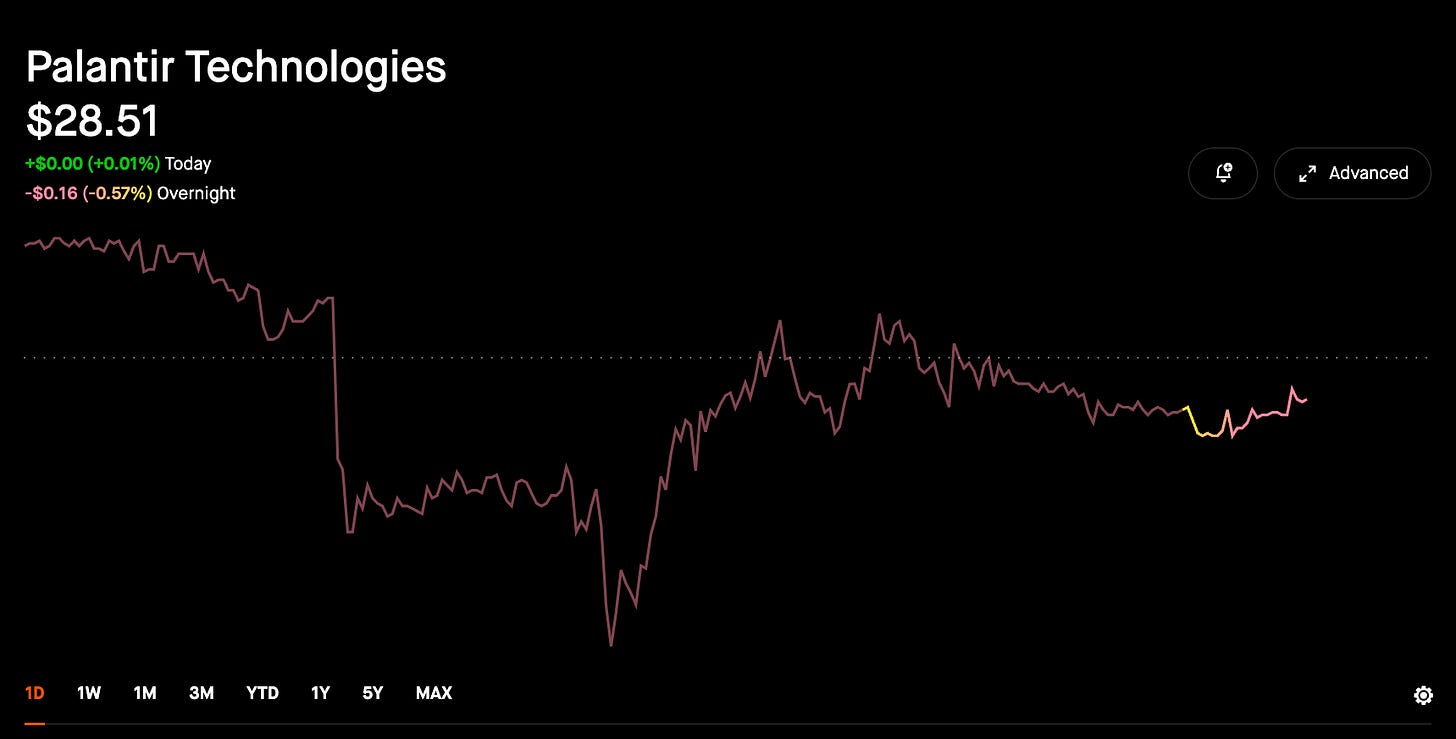

Despite the downgrade, Palantir's price action remained resilient. After an initial dip to $27.47, the stock recovered and closed above $28.50, indicating strong support levels and buying interest. This reaction suggests that many investors and institutions still believe in Palantir's long-term potential and are willing to buy on dips, even in the face of negative analyst reports.

We closed at about $28.50 today, at one point going green on a major downgrade.

The quick recovery price suggests that institutions might view the downgrade as an opportunity to accumulate more shares before the company's next earnings report. This behavior can indicate a strong belief in Palantir's underlying business and growth prospects.

Palantir's ability to maintain its stock price above critical support levels, despite the downgrade, is significant. It demonstrates that the market has confidence in the company's valuation and future potential. This resilience is crucial as it sets a new base for the stock, making it harder for it to fall below certain levels even if short-term performance doesn't meet expectations.

Trump Picks A New VP

Alright, we have to go through who Trump just picked to be his VP.

Peter Thiel and JD Vance

J.D. Vance being elected as Donald Trump's VP is significant for Palantir due to his deep connections with Peter Thiel, a co-founder of Palantir. Thiel has supported Vance's political and business ventures for years, creating a strong relationship between them. This bond suggests that Vance is well-acquainted with Palantir and its technology, potentially making him an advocate for the company if he enters the White House.

How close are they? So…

Vance worked at Mithril Capital, Thiel's VC fund, and later co-founded his own fund, Narya Capital, with Thiel's support. Thiel then supported his run for senator from Ohio.

Not only did he work under Thiel, he got funded by Thiel in business and politics. Mithril is an object from Lord of The Rings, and JD named his VC fund after another object — Narya. Palantir is a reference from Lord of The Rings as well. It seems safe to say that JD understands and knows about Palantir.

But, it gets deeper…

One of the key investments made by Narya Capital was in Chapter, a medical advisory startup.

Chapter's technology platform, which integrates data on Medicare plans, was built using Palantir's technology.

From a PR: “The company strives to ensure its work is genuine and ethical. Chapter also partners with Palantir on its tech platform, which integrates the data on all Medicare plans and allows its advisers to make the most informed recommendations.”

Why does this matter? At its core, JD obviously had to research and learn about Palantir over the past decade. No sophisticated VC would invest in a $42M funding round without understanding the internal tech around how a startup is building their proprietary platform.

If JD not only got funded by the cofounder of Palantir but also funded companies like Chapter building on top of Palantir, we can make the argument that he understands the company very well…which could be good for Palantir.

The Importance of Connections

Having a VP who comprehends and appreciates Palantir’s tech could lead to increased government contracts and support for the company. Vance's potential influence on policies and contracts could significantly benefit Palantir, aligning with the broader trend of political connections impacting business success. This scenario is especially likely given Thiel's strategic role in supporting Vance's career.

Moreover, Thiel’s close relationship with Vance could provide Palantir with a direct line to the White House, facilitating discussions on policy and contracts that could favor the company. This insider access could be a game-changer for Palantir, allowing it to leverage its technology more effectively within the government sector.

For those that feel this isn’t a good thing…having connections is crucial in life because they open doors to opportunities and resources that might otherwise be inaccessible. Every big tech company spends millions on lobbying. You need to know people to get things done, which is actually how Palantir grew their government business: they went through the pain of knowing no one, then started to know everyone, and now they have those relationships to help them win larger deals.

If Vance becomes Vice President, his understanding of Palantir's technology and its value could influence government policies and contracts favorably towards the company.

Vance's relationship with Thiel and their shared history build a foundation of trust, making their collaborations more effective. For Palantir, this means having a trusted ally in Vance, who understands the company's vision and can advocate for its needs. Trust is a critical component of any successful relationship, and it is often built through long-term connections.

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!

Amit, I would be interested in your take on the relationship between JD Vance and Peter Thiel and the impact this may have on Palentir. I am asking an honest question, not one rooted in bias.