Palantir Gets A MAJOR New Price Target Today From An Old Friend...

Morgan Stanley upgrades/downgrades at the same time

Welcome back to DailyPalantir! On today’s newsletter, we dive deep into the latest MS report on Palantir along with looking at what Jeffries said today. We also have an official date for Q4 2024 Earnings. Let’s get into it!

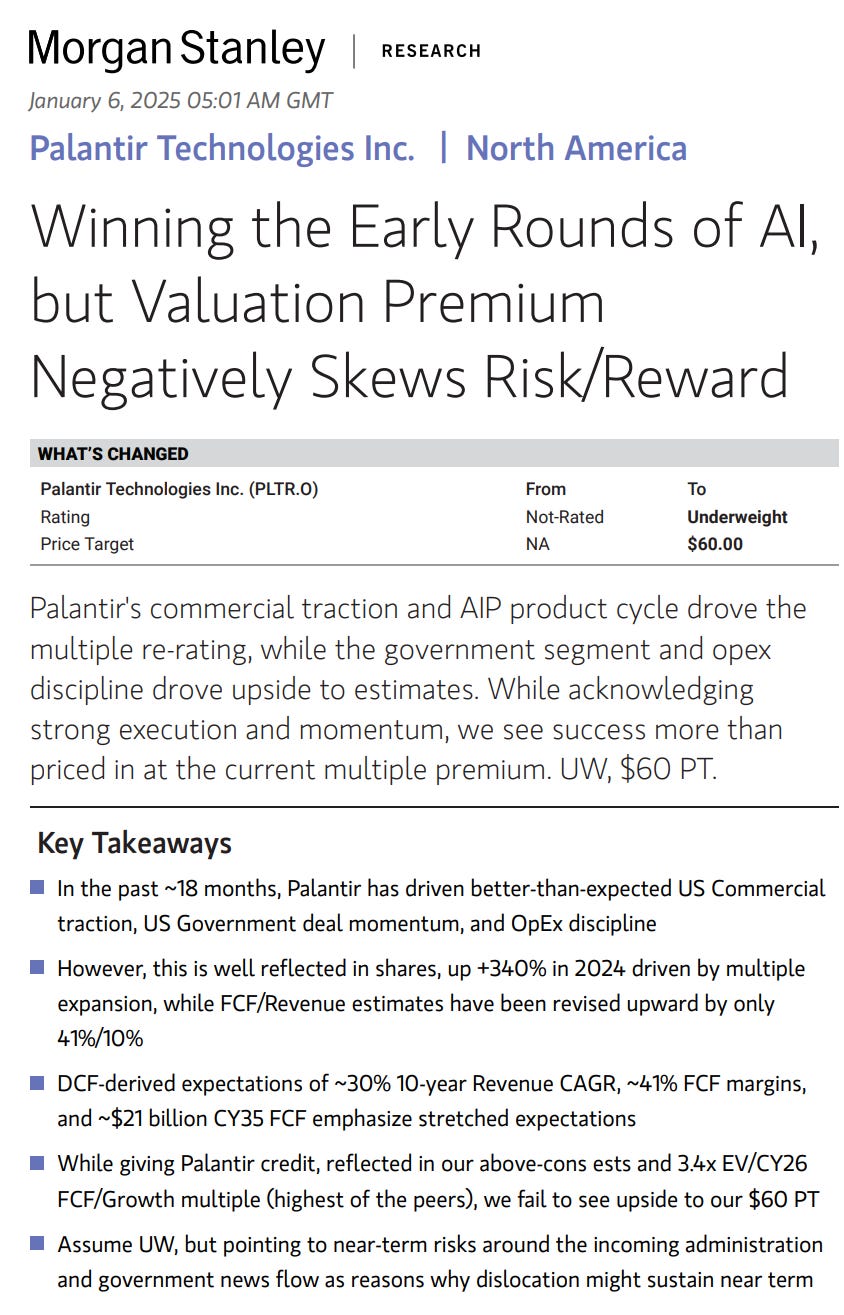

Morgan Stanley’s Palantir Report: A $60 Price Target

The Report and Its Implications

Morgan Stanley recently released a report on Palantir, assigning the stock an underweight rating and a $60 price target. This target, lower than Palantir’s current trading range of around $80, reflects a cautious view on its valuation. However, the report doesn’t dismiss Palantir entirely. Similar to UBS’s earlier analysis, it acknowledges the company’s strengths while expressing concerns about its extended valuation. Investors are left to interpret whether this cautious tone should be seen as a negative or as a potential opportunity.

Palantir’s stock has been one of the standout performers in recent times, driven largely by its positioning in the AI sector. The company’s focus on generative AI and its strong government contracts have placed it in a unique spot among software companies. Yet, Morgan Stanley’s report highlights an important question: is the current valuation justified, or has the stock moved too far, too fast? These questions form the foundation of the firm’s analysis.

Morgan Stanley’s mainly has an issue around Palantir’s valuation. The analysts argue that the stock’s growth in 2024 was largely driven by multiple expansion rather than significant revenue growth. They highlight that Palantir is trading at a 56x EV-to-sales multiple, far ahead of its peers. Furthermore, the firm points out that Palantir’s recent free cash flow improvements stem from cost discipline rather than revenue increases, suggesting limited organic growth in the near term.

Another point of concern is the uneven performance of Palantir’s commercial and government businesses. While the government segment continues to deliver, the commercial side has lagged in driving meaningful revenue revisions. With management signaling an investment cycle ahead, Morgan Stanley remains cautious about further expansion. Despite these concerns, the report acknowledges Palantir’s role in the generative AI space, which could support its valuation if execution improves.

Why This Report is Still Bullish to Me

For long-term investors, Morgan Stanley’s report could be seen in a positive light. The $60 price target, while lower than current levels, marks a significant improvement from the firm’s earlier targets of $12 and $20 in 2024.

Let me say that again: 1 year ago, Morgan Stanley thought Palantir was worth $12. They now think it’s worth $60.

The normalization of price targets in the $60-$80 range also challenges the narrative that Palantir is grossly overvalued. Analysts who previously dismissed the stock now acknowledge its progress and potential. This shift could encourage more firms to initiate coverage, further boosting Palantir’s credibility. For investors, this evolving sentiment is an important signal of Palantir’s transition from a speculative play to a more widely accepted growth story.

Morgan Stanley’s evolving view of Palantir underscores the often reactive nature of institutional analysis, which is why retail investors had the edge on this company to begin with. This new price target highlights the lag between market performance and analyst sentiment. For investors who identified Palantir’s potential early, this shift reaffirms the importance of independent research and conviction.

The report also serves as a reminder that valuation concerns, while valid, don’t always capture the full story. Palantir’s focus on AI and its differentiated approach to software and data analytics have positioned it as a leader in its space. While metrics like EV-to-sales multiples are important, they don’t account for the company’s long-term potential, especially in a rapidly evolving sector like AI.

Impressing Analysts

Palantir’s challenge now is to justify its valuation by delivering consistent growth. The commercial business, in particular, will need to show stronger contributions to revenue. Management’s ability to guide this growth while balancing costs will be critical in maintaining investor confidence. If Palantir can achieve these goals, it may not only sustain its current valuation but also exceed future expectations.

It’s not just Morgan Stanley with valuation concerns. They have a higher PT on the stock, but firms like Jeffries continue to believe the growth is not strong enough:

I’ll discuss my Q4 earnings expectations in the coming weeks, but we would need to see 30%+ growth guidance for 2025. If not, the narrative could be that Palantir is exciting but can’t grow. I actually think they can get to 40% growth in 2025, for reasons I outlined below, but this is what the street is going to be looking for.

Also, we will have earnings on February 3rd:

Getting to 40% growth:

I think there is a world where Palantir can achieve 40% growth by the end of 2025:

- New catalysts and tailwinds for the government business including DOGE, renewal of contracts (as we saw with Army Vantage for $619M), increased spend on AI/software, new partnerships to create more joint contracts.

- AIP monetization is just beginning and scaling with a Pay-By-Consumption model. Palantir only has 600 customers, which is quite literally nothing compared to the amount of customers they could have. They are in the VERY early stage of getting customers onto their ecosystem and given what we know about how sticky it is (and we can see this in net dollar retention trending up), then we should see customer count growth beginning to get to the 800-1000 mark over the next 18 months.

- Palantir’s new media coverage is a compounding effect not only on the stock as more investors are getting interested but also for customers. The more their name is pitched as THE AI operating system, the more their inbound is likely increasing with more potential customers who want to sign up to a bootcamp which should drive even stronger adoption with conversions.

- LLMs are being commoditized. It’s that simple. We are in the VERY beginning of making LLMs useful and most enterprises are realizing why an Ontology matters. If the promise of enterprise AI is margin expansion and efficiency, that requires an operating system, not an LLM. As this thesis plays out, more and more companies should be integrated into Foundry and that should allow them to scale average rev per customer with AIP.

- No debt. Almost $5B in cash. FCF of $1B+. Institutional ownership above 50%. GAAP profitable. 40% growth is what takes the story to the next level.

What does this mean for the stock? Few implications…

1. We haven’t had a real market correction yet. If we do and Palantir is able to show max pain of around $60, that is REALLY bullish. If the market falls 10-15% and Palantir can hold the $60s, it only confirms our thesis that the big guys are controlling this name now and they are not letting it head lower because they want to buy on dips.

2. If the market does pullback hard and Palantir gets into the $40 range, the bears will laugh for a day, the bulls (many of which will still be in the green) will buy that dip. I think it will be very hard to see the $40s but no one I know who understands Palantir would be scared to add at this range again given how fast it ran from $40 to $65 and most people just didn’t get the chance to add at those levels.

3. Now, if we get to 40% growth, I’m not saying that it completely justifies the extended multiple we are trading at — but that won’t matter. What other software AI names are compounding at 40% that are actually making LLMs meaningful in an organization? OpenAI at $150B is losing money and is becoming commoditized by the day. Palantir is one of the only names that can actually scale into MULTIPLE verticals with Foundry/AIP/Apollo/Gotham/WarpSpeed and is doing so PROFITABLY. The street will pay a strong multiple for that if they can grow 40% as no other AI name will be left that can show that trajectory of growth. This means the name WILL BE EXPENSIVE probably forever but expensive should not be the “bear case” and if it is then most people will likely never get or own Palantir.

4. If we grow 40% and the stock stays flat/slightly down this year then that just means the street is consolidating in this $60-$80 range and is not giving the benefit of pulling forward any more growth. While a flat year wouldn’t be awesome, most people can’t complain as we are up more than 10x from the lows and a year of consolidation would just further provide the opportunity for more share accumulation. However, with the media coverage and excitement around the name AND a potential 40% growth story, I think many new investors/funds will begin a position.

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!

I’m grossly overweight with $PLTR at 49% of combined portfolios. It’s also my most profitable holding. Now all I have to do is live long enough to see if my continuing confidence is appropriate.

The CEO comes off as a wacko (Bipolar) type, I don't trust his leadership.