Welcome back to DailyPalantir! Today we’ll discuss Palantir’s lack of S&P 500 inclusion, their latest deal with Ukraine, and Snowflake earnings. Let’s get into it!

No S&P 500 For Palantir, Yet

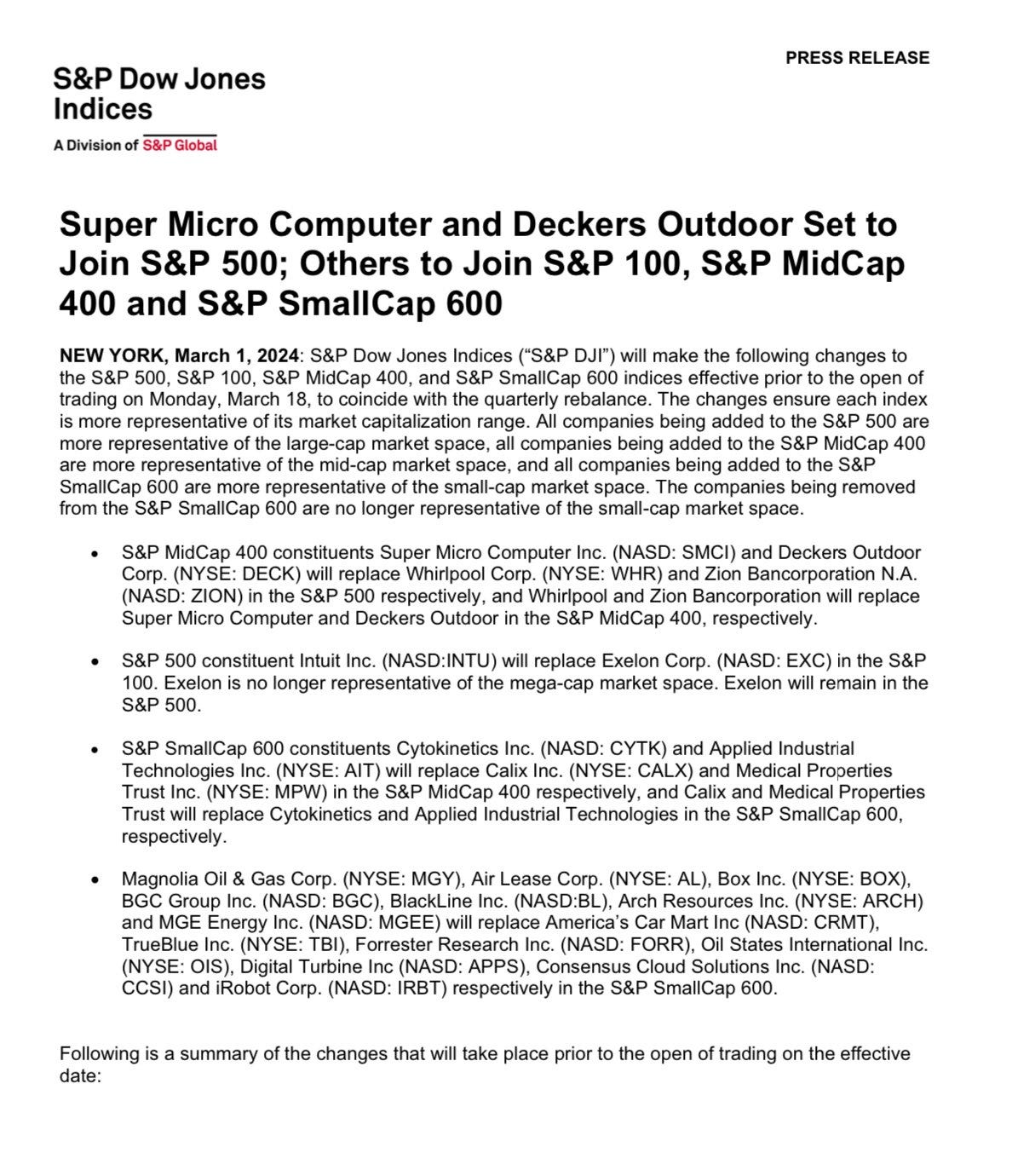

Palantir was not added to the S&P 500 last Friday, SMCI and Deckers were.

Now the main reason, in my opinion, seems to come from Palantir’s low institutional ownership, which if included into the index, would have had the second lowest institutional ownership out of all 500 companies.

Deckers, a shoe brand, has 4x the net income of Palantir, but half the market cap.

At the end of the day, this really is going to be a question of what the S&P committee is looking for — I personally think they want to see higher ownership stakes and less volatility in the stock, but it could be anyone’s guess.

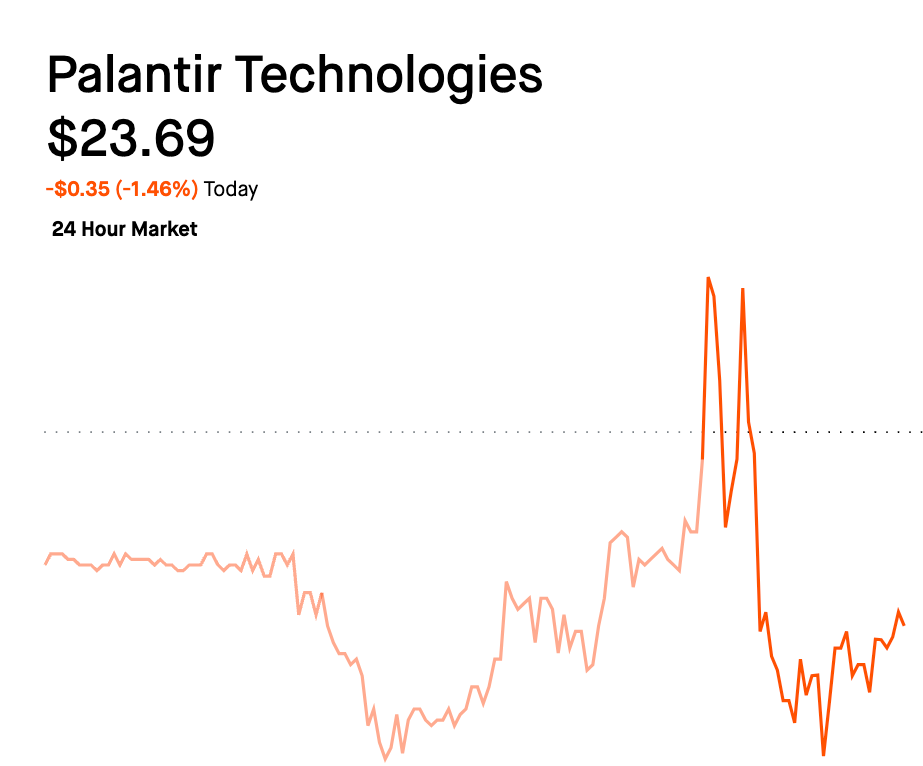

Now, before the S&P news came out, the stock spiked to $25.69, a new 52 week high. Once the news was out, we fell about 5%. The good news is that Palantir is consolidating nicely in this $22-$25 range, showcasing that it seems like below $20, barring any major macroeconomic event, seems to be out of the picture.

Palantir’s Newest Deal With Ukraine

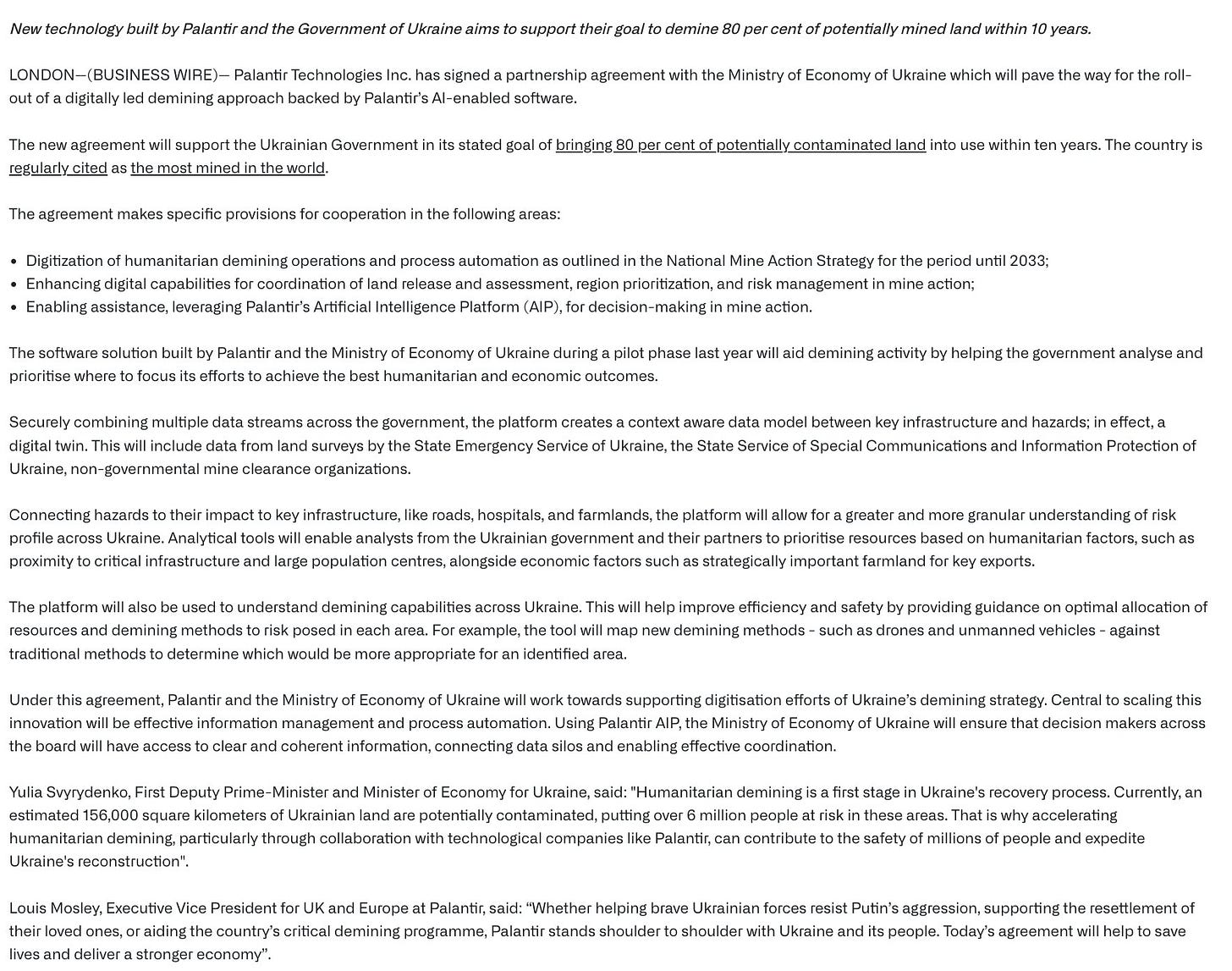

This was a really good deal. We are going to be working with Ukraine till 2033 by implementing AI to find landmines and get rid of them.

NATO will one day be a very big market for Palantir — getting deals like the one we got today with Ukraine will be crucial in order to get trust from NATO.

Ukraine has received hundreds of billions from the US government — there is no word on if this deal is worth any money of it’s free, but I imagine that Palantir is monetizing in some way. If they are doing it for free, it’s because they know establishing a good relationship with Ukraine will one day pay off well. Given that its a deal to implement AI software to find landmines till 2033, I do believe Palantir is getting paid from this, but we don’t know how much.

Palantir has a broader partnership with the Ministry of Digital Transformation in Ukraine, so I suspect more deals for Palantir to rebuild and implement software to bring Ukraine back to where it was before invasion will materialize over the next 5 years.

Snowflake Gets Hit

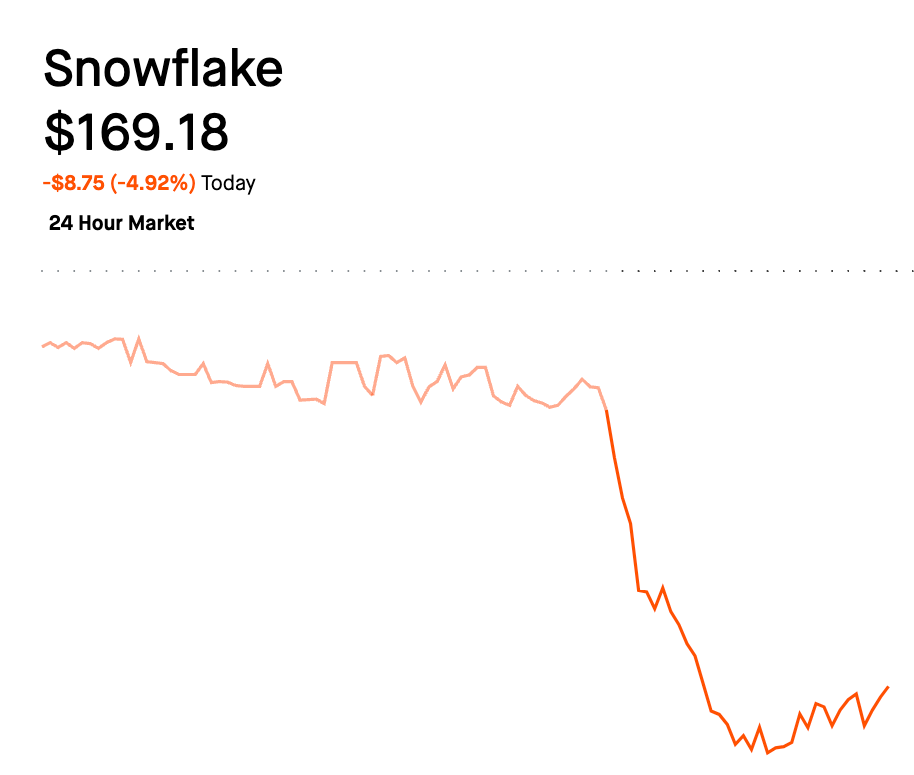

Snowflake has had a rough week.

Snowflake and Palantir tend to be seen as competitors, although they don’t exactly compete in the space space.

Snowflake is a cloud-based data warehousing company that was founded in 2012. It provides a platform for data storage, processing, and analytics services, known for its ease of use and scalability. Snowflake's architecture allows for the separation of storage and compute functions, enabling customers to scale up or down quickly and pay for only what they use.

Palantir offers a suite of software applications that emphasize data integration and analytics for complex operations.

Snowflake provides a cloud-based data warehousing solution with a focus on storage efficiency and scalability.

Palantir's client base includes government agencies and large enterprises with specific security needs.

Snowflake's services are utilized by a wide range of customers who require flexible data warehousing options.

Palantir's platforms are tailored for industries that need to solve unique challenges through customized applications.

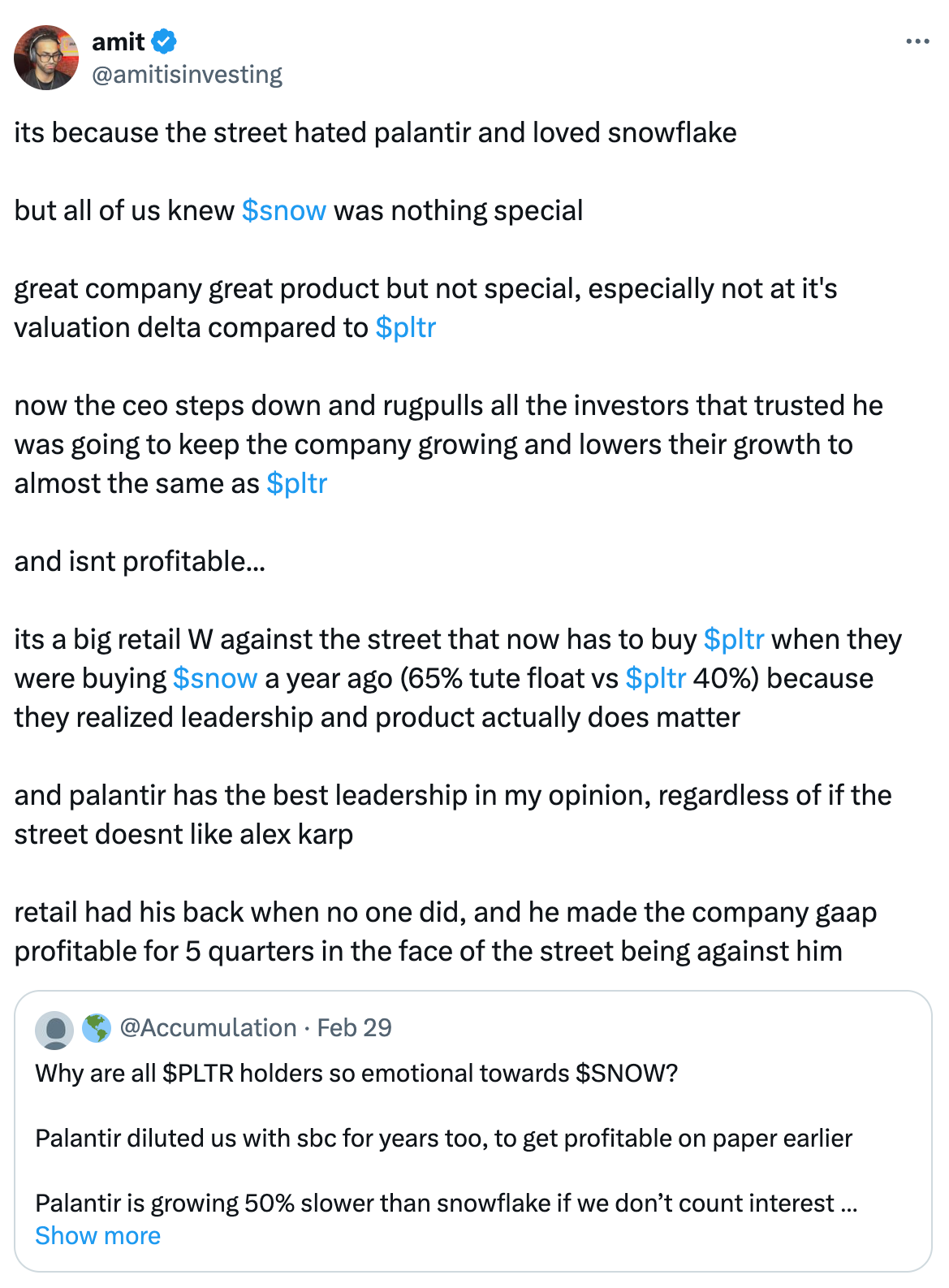

So, although they are different companies, they do get compared to each other often, especially since Snowflake has always traded at a significant premium to Palantir — the street has always loved the stock.

Not after this recent earnings.

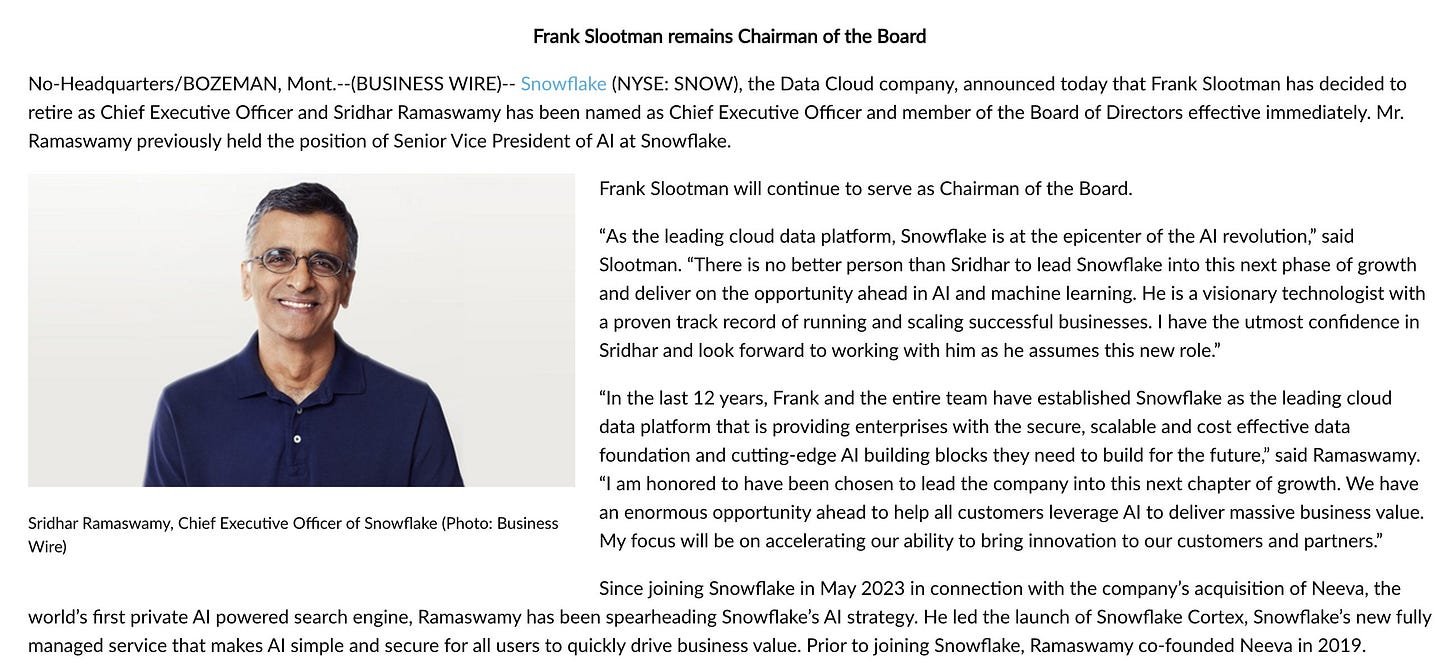

Snowflake is down 26% post earnings — the main reason for this is because their CEO, Frank Slootman, is now going to be the chair of the board and they brought in a new CEO.

The street was blindsided by this. The new CEO has an amazing track record, but leading a public company is a different animal.

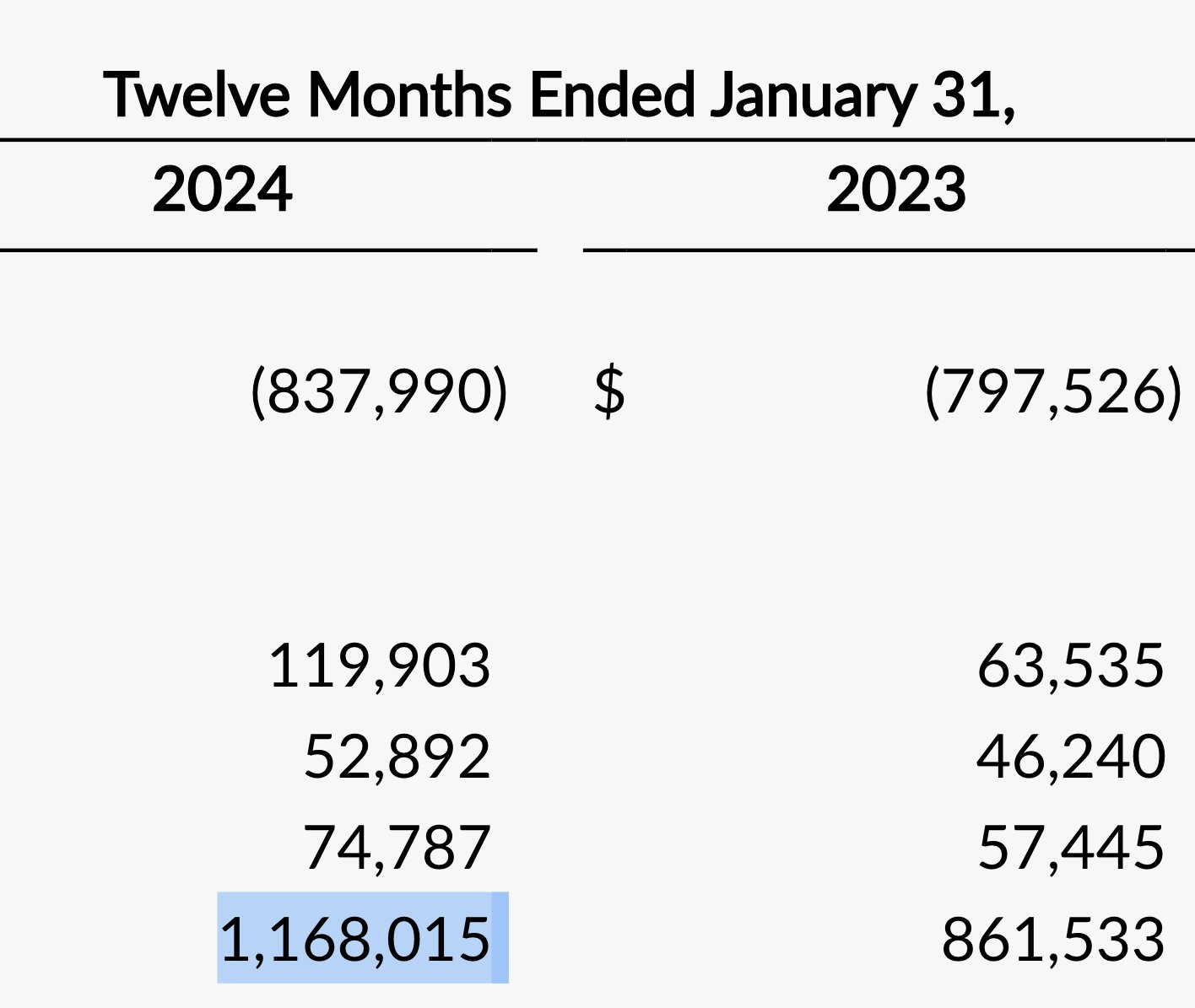

On top of that, two different things happened with their numbers — they lowered guidance to only 22% FY growth, and stock based compensation jumped to $1.1B.

Now, why does this matter for Palantir?

Well…

Look, I don’t think Snow deserves to be down almost 30% post earnings and they likely will recover.

But the CEO stepping down was a sign that they are likely not moving fast enough on product innovation and needed someone else, which is something Palantir shareholders have been saying for a while in terms of how quickly Palantir can move to get products out and how they don’t need to acquire other companies to grow.

And, I think the street is realizing that there needs to be transformational value achieved for enterprises, not just a place to store your data. Snowflake likely will introduce some products that are really good for the enterprise, but I’m not sure if they will be at the level that Palantir is at. Palantir did $430M of stock-based compensation last year on $2.2B of revenue. Snowflake did $1.1B in SBC on $2.6B of revenue.

$SNOW since going public = -21%

$PLTR since going public = +172%

My New Product Launch

So, I said in January I was working on a brand new product that would be really cool for Palantir investors. It’s done.

I’ll be launching it publicly on Friday but will be launching it to the newsletter on Wednesday night. It’s free to sign up and use until you hit a certain level of usage, and then it costs $42.69 (lol) a year to have unlimited use of it.

It’s a really simple product, I tried to price it as cheaply as possible (comes out to about $3.5/month) and if you are a Palantir investor, I think it is a no brainer to have access to it. Some people will use it daily, some will use it weekly/monthly, but I do believe the value of it will far exceed the cost.

I will launch it to the newsletter Wednesday night — my goal here is I don’t want people paying me for content, I do know many people have wanted to show some type of support, so hopefully this is a product that allows you to support the work but also you get something really cool to use that will be updated daily to get better and better.

For anyone who subscribed to substack’s yearly subscription, I will be emailing you a discount code to access the product for free.

It’ll be fun! & the marketing of it will be even more fun…

That’s it for today — thank you for reading and I’ll see you tomorrow in your inbox!