Welcome back to DailyPalantir! In this newsletter, we’ll break down Palantir hitting $30 after a monster Q2 earnings. Let’s get into it!

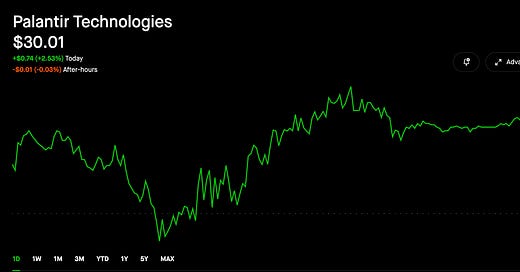

Well, we hit $30 folks.

It’s been quite a ride since we got here, but we are here.

When Palantir's stock hit $30 a share, it was a huge moment for the community. I was live for 4 hours trying to see us go from $29.99 to $30, and it was an entire community event.

We've been together for years, many of us since the stock was down at $6 or $7, trying to understand the company after it dropped from $25. Now, seeing it climb back into the high 20s and touch 30 is a validation of all the belief and patience we've had in Palantir's potential. It feels like we've been on a journey together, and hitting $30 is a significant milestone that makes all those early doubts and struggles worth it.

This isn't just about the numbers; it's about the community we've built around this company. When we had almost 7,000 people join a live stream to discuss the earnings, it showed how engaged and passionate we all are. Watching Palantir grow and seeing the stock price reflect that growth has created a sense of excitement and optimism among us. We've seen this company transform from something that was easy to doubt into a success story, and it feels like we've all played a part in that by sticking with it.

Hitting $30 a share also brings a new level of energy and confidence to the community. It’s not just about making money—it’s about being part of something bigger. We've all believed in Palantir's potential to be more than just another tech company, and now that it's being recognized by the market, it reinforces that belief. It's motivating to see that what we saw in Palantir is finally being acknowledged by others, and it makes us even more excited about what the future holds.

For me personally, covering Palantir has been a rewarding experience, especially now that the stock is performing so well. It’s incredible to see how the company has evolved and to know that the community I've been part of is growing and thriving alongside it.

As we move forward, hitting $30 is just the beginning. It feels like we’re still just getting started, both as a community and as a company. The excitement we feel now is going to carry us through the next phase of Palantir's growth, and I’m just as eager as everyone else to see where this journey takes us. The community is stronger than ever, and with Palantir’s continued success, there’s no limit to what we can achieve together.

2 weeks after hitting $30, we hit $32, now closing above $30 for the past 5 trading sessions:

Let’s get into the Q2 numbers…

Big Picture thoughts

Palantir's Q2 2024 earnings were nothing short of impressive, marking one of the best quarters the company has ever had. The big headline here is the re-acceleration of growth, which is something that's incredibly difficult to achieve for a public company. Palantir managed to push its revenue growth back up to 27% year-over-year, after hovering in the low 20s for some time. This kind of growth shows that the company has successfully turned a corner, proving that its strategy, leadership, and execution are all on point.

What makes this quarter particularly exciting is that Palantir has not only regained its growth momentum but is also doing so profitably. The company reported a GAP net income of $134 million, the highest it's ever had, with a massive 500% year-over-year increase in earnings per share (EPS). This profitability, combined with the strong growth numbers, positions Palantir as a major player in the tech space, particularly among SaaS companies, which investors often reward with higher valuations when they see this kind of performance.

Another key takeaway from these earnings is the strength in both the commercial and government sectors. U.S. commercial revenue jumped by 55% year-over-year, and the company saw an 83% increase in its U.S. commercial customer count, which is a strong indicator of future revenue potential. On the government side, revenue grew by 24% year-over-year, showing that Palantir's foothold in this sticky, reliable sector remains strong. This balanced growth across different revenue streams further solidifies Palantir's position as a robust and diversified company.

Palantir's stock responded to these earnings by hitting its highest level since February 2021, closing in on $30 a share.

Customer Count

One of the things that really stood out to me in Palantir's Q2 2024 earnings was how fast the customer count is growing, especially in the U.S. commercial sector. The fact that Palantir's U.S. commercial customer count grew by an incredible 83% year-over-year is a big deal. More companies are realizing the value of Palantir's products, particularly Foundry, and it's becoming the go-to choice for businesses. With 295 customers now in the U.S. commercial space, it’s clear that Palantir is gaining serious traction.

What's even more impressive is that Palantir’s overall customer count is up 41% year-over-year, growing from 421 to 593 customers. This rapid growth in customers is setting the stage for a lot of future revenue. Even though some of that revenue might not have been fully realized yet, the expanding customer base means there's a ton of untapped potential just waiting to be monetized. It feels like we're just scratching the surface of what Palantir could bring in from all these new customers.

What’s really exciting is that customer growth is actually outpacing revenue growth. While revenue grew by 27% year-over-year, the customer count in the U.S. commercial sector is growing four times faster than that. That’s a key insight because it shows there’s a growing pool of customers who haven't yet reached their full revenue potential. As these companies scale and use Palantir's solutions more deeply, we could see a huge increase in revenue per customer over time.

This growth isn’t just limited to the U.S. commercial side, either. While the government business remains strong and reliable, the surge in commercial customers is driving the company’s overall growth trajectory. With customer count growing 7% quarter-over-quarter, Palantir is clearly building momentum in attracting and onboarding new clients. It’s exciting to watch that growth pick up speed.

Looking ahead, this massive growth in customer count is setting Palantir up for even greater success. As Palantir continues to turn these customers into larger revenue streams and keeps its strong foothold in the government sector, the company is only going to get stronger. Analysts are starting to see this too, raising their price targets as they recognize just how significant Palantir’s expanding customer base really is. It’s not just about how many customers they have now—it’s about what all this growth means for the future.

Government Growth

Palantir’s Q2 2024 earnings revealed some exciting developments in the government sector, which is a core part of the company’s business. Government revenue growth re-accelerated to 23% year-over-year, compared to 16% in the previous quarter. This is a significant jump, showing that Palantir is deepening its foothold in this critical sector. U.S. government revenue, in particular, grew by 24% year-over-year, up from 12% last quarter. This kind of growth is exciting because the government side of the business is incredibly sticky, providing a solid foundation of revenue that Palantir can rely on.

What’s really interesting is how Palantir’s government contracts are proving to be a moat for the company. The government isn’t going to start switching to other vendors once they’ve integrated Palantir’s systems—especially with Palantir’s level six security clearance. Palantir’s ability to secure these contracts and maintain such high-level clearances means they’re deeply embedded in critical government operations. For example, Palantir's $480 million Maven contract with the Department of Defense was a huge win this quarter, reinforcing their position as a key player in defense technology.

The partnership with Microsoft, which was announced during this quarter, is another major highlight for Palantir’s government growth. Microsoft and Palantir are teaming up to deploy Azure’s OpenAI models through Palantir’s AIP into the government space, leveraging Palantir’s security clearances. This partnership shows that Palantir is not just maintaining its government relationships but expanding them with new technology and collaborations. It’s a big vote of confidence from Microsoft and highlights Palantir’s importance in government tech.

With $371 million in government revenue during Q2, Palantir’s strength in this area is undeniable. The government business is a crucial part of what makes Palantir’s overall financial picture so strong because these contracts provide a reliable stream of revenue every quarter. When you have large, long-term contracts with government agencies, it creates a level of stability that can help fuel growth in other areas of the business, like commercial.

As Palantir continues to grow its presence in government, this part of the business is likely to remain a cornerstone of their success, helping to drive both revenue and long-term stability for the company.

Operating Margins

One of the things that really stood out to me in Palantir's Q2 2024 earnings was the improvement in their operating margins. They managed to increase their adjusted operating income margins to 37%, up from 36% last quarter. This shows that Palantir is becoming more efficient as a company, finding ways to reduce costs while still driving strong revenue growth. It’s clear they’re not just focused on expanding the top line, but doing so in a way that’s profitable and sustainable.

What’s even more exciting is the potential for these margins to keep climbing. I’m confident that Palantir could hit 40% operating margins by the end of the year, if not sooner. That’s a big deal because it means they’re not only growing revenue but optimizing their operations at the same time. When a company can scale and improve profitability like this, it signals to investors that the business is on a solid, sustainable path for the long term.

This focus on margins is especially important because Palantir is balancing both top-line and bottom-line growth. They’re pushing for about $700 million in revenue next quarter while keeping their expenses in check, which is allowing their operating margins to rise. This combination of strong revenue growth and improving profitability is exactly what gets investors excited and can lead to higher valuations for the stock.

As Palantir’s operating margins grow, so do their free cash flow margins. They’re on track to generate $1 billion in free cash flow this year, which is a direct result of these higher margins. This gives Palantir a lot of financial flexibility—they can reinvest in the business, buy back shares, or even pursue strategic acquisitions. It’s a strong position to be in and shows that the company is managing its growth effectively.

In the bigger picture, Palantir’s rising operating margins show that they’re hitting their stride as a company. They’re scaling efficiently, leading to higher profits and better financial stability. As these margins continue to improve, I believe Palantir will be rewarded with a premium valuation from the market. Investors are going to recognize that this is a company that’s not only growing fast but doing so profitably, and that’s a recipe for long-term success.

Conclusion

After going through Palantir’s Q2 2024 earnings, I can confidently say that the company is in a strong growth phase, and it feels like they’re just getting started. Their ability to re-accelerate growth, especially after a period where growth had slowed, is impressive. They’ve pushed their year-over-year revenue growth back up to 27%, and it looks like there’s potential to hit 30% in the near future. This shows that Palantir has found a winning strategy, and their management is executing at a high level.

What’s also exciting is how broad-based this growth is. Palantir is seeing strong numbers across both their commercial and government segments, which gives them a diversified revenue base. In the U.S. commercial sector, their customer count is exploding, growing 83% year-over-year. This customer growth lays the foundation for continued revenue growth in the future, especially as these new clients ramp up their spending. Meanwhile, the government side remains a reliable source of revenue, with Palantir continuing to secure large, long-term contracts.

Financially, Palantir is not just growing, but they’re doing it profitably. Their operating margins are improving, and they’re generating substantial free cash flow—on track for $1 billion this year. This financial strength gives them the flexibility to reinvest in the business, buy back shares, or even pursue acquisitions, which can further fuel growth. It’s not just about top-line expansion; it’s about building a business that’s sustainable and efficient.

What stands out to me is the sense of momentum Palantir has right now. They’ve figured out how to re-accelerate their growth while keeping profitability in mind, and they have the leadership in place to keep pushing forward. The community around Palantir is energized by this success, and with the company performing at this level, it’s clear that they have the potential to become one of the top players in the tech industry. The numbers are starting to reflect what many of us have believed about Palantir for years—it’s a company with massive long-term potential.

Palantir’s growth story is just beginning to unfold. The company has shown it can deliver on its promises, and with both revenue and profitability on the rise, I’m confident that there’s still a lot of room for this company to continue to show investors what they can do.

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!