Welcome back to DailyPalantir! Today we get a brand new Palantir Client & discuss the Sell Rating set by two banks. Let’s get into it!

Brand New Palantir Client

Alright folks, we got a new client — and it’s an international one! Here’s the PR below, and then we’ll discuss:

Palantir Partners with One of Australia’s Leading Retailers

Coles Supermarkets will deploy Palantir platforms to all 850+ stores in Australia

DENVER & SYDNEY--(BUSINESS WIRE)-- Palantir Technologies Inc. (NYSE: PLTR) (“Palantir”), a leading provider of AI systems, and Coles Supermarkets Australia Pty Ltd (ASX: COL) (“Coles”), one of the leading Australian supermarket, retail and consumer services chains, announced today a 3-year partnership to deliver a suite of workforce strategy and analytics tools. Palantir’s platforms will bring an innovative approach to driving operational excellence and improving the way Coles designs, executes and continually enhances its end-to-end workforce strategy and integrated supply chain functions.

Coles will leverage Palantir platforms, including the Artificial Intelligence Platform (AIP), across its store operations to better understand and address workforce-related spend. By integrating data into one system, Coles will connect its C-Suite to the shelf-edge in stores across its more than 840 supermarkets. Coles plans to support decision-making to optimise its workforce – including better workforce planning, shift efficiency, and a more granular understanding of spend as it relates to enhancing the experience for shoppers. Critically, Store and Department Managers will be able to make real-time decisions to optimise costs and improve both customer and team member experience.

“In line with a broader data strategy, we have partnered with Palantir to explore opportunities to operationalise our Advanced Analytics ‘Smarter Forecast’ and redefine how we think about our workforce. We are excited by the capability the Foundry platform brings to rapidly leverage beyond dashboards, and provide a suite of tools utilising AI to our front-line teams. This will allow them to respond more dynamically to ever-changing trading conditions and customer needs,” said Matt Swindells, Chief Operating & Sustainability Officer. “Our development work with Palantir has demonstrated how we can enhance our ability to ensure all departments are optimally resourced – to provide not only the best return on workforce spend, but to drive better customer outcomes in-store. The most exciting part is that we are only just beginning – with a detailed roadmap of work to deliver over the coming years in line with our Simplify & Save to Invest program.”

Configured on Palantir, the suite of workforce tools will identify opportunities over 10 billionrows of data, comprising each store, team member, shift and allocation across all intervals in a day, every day. Foundry enables these capabilities by bringing legacy data systems and machine learning into a shared end-to-end view of Coles’ retail ecosystem, including Bakery Production Planning tools for in-store bakeries and Ocado Fulfilment Centres.

“Our partnership with Coles – an iconic Australian retailer – demonstrates the strength of our Australian commercial business and continues our growth in the retail industry globally,” said Ashwin Rajan, Head of Commercial for Australia at Palantir. “Our collaboration showcases how Palantir can be integral to core operations at Coles. In a challenging retail environment, we are intending to enable Matt and the Operations teams to drive their digital transformation agenda at scale, empowering front-line teams to leverage the latest in AI and data to deliver enhanced customer and P&L outcomes every day.”

This was a fun PR to see.

So going into 2024, we now have 3 deals: 2 in the health care space, one in the commercial grocery space — these are the deals that have been publicly announced at least.

After this deal came out, I spoke to many people who actually live in Australia. Apparently, Coles Supermarkets is like Krogers or Walmart of the USA. Every single person I spoke to said that this grocery chain is the leading brand in Australia and people generally live 5 minutes away from a Coles…very similar to Walmart in the USA.

Then, I started digging deeper into the company. They did $41B in sales in 2023.

This is not a small company. This is a 3 year deal for AIP + Foundry, and I expected to be worth a decent chunk of change.

What’s really interesting about the deal is how it’s continuing to show the diversity of Palantir’s software being integrated into so many different sectors. For the past 2 weeks we’ve been discussing the healthcare and defense sector operationalizing AI…now we’re talking about a grocery chain?

And it makes sense…grocery chains, at this scale, have massive amounts of data they need to organize. The PR mentions about 10B rows of data in regards to supply chains, staffing, etc. would be managed with Palantir. Palantir would truly become the operating system for all 840 locations throughout Australia.

If Palantir can do this for a company like Coles, why can’t they do it for a Walmart or a Target? Why can’t they do it for the Coles of South Korea or Coles of Japan?

In fact, if this partnership goes well, it almost begs the question of Palantir building something similar to skywise but for the retail-chain industry that deals with the type of raw data a Coles deals with & then expanding that model throughout all these retail chains with thousands of locations across the world. The network effects will compound and only make a system like this better as more grocery chains adopt it, leading to better results and operational efficiency for those chains.

This is a fun, fun partnership — and if it signals anything about Palantir’s 2024 customer growth, then earnings should be exciting.

RBC & Citigroup Say to Sell

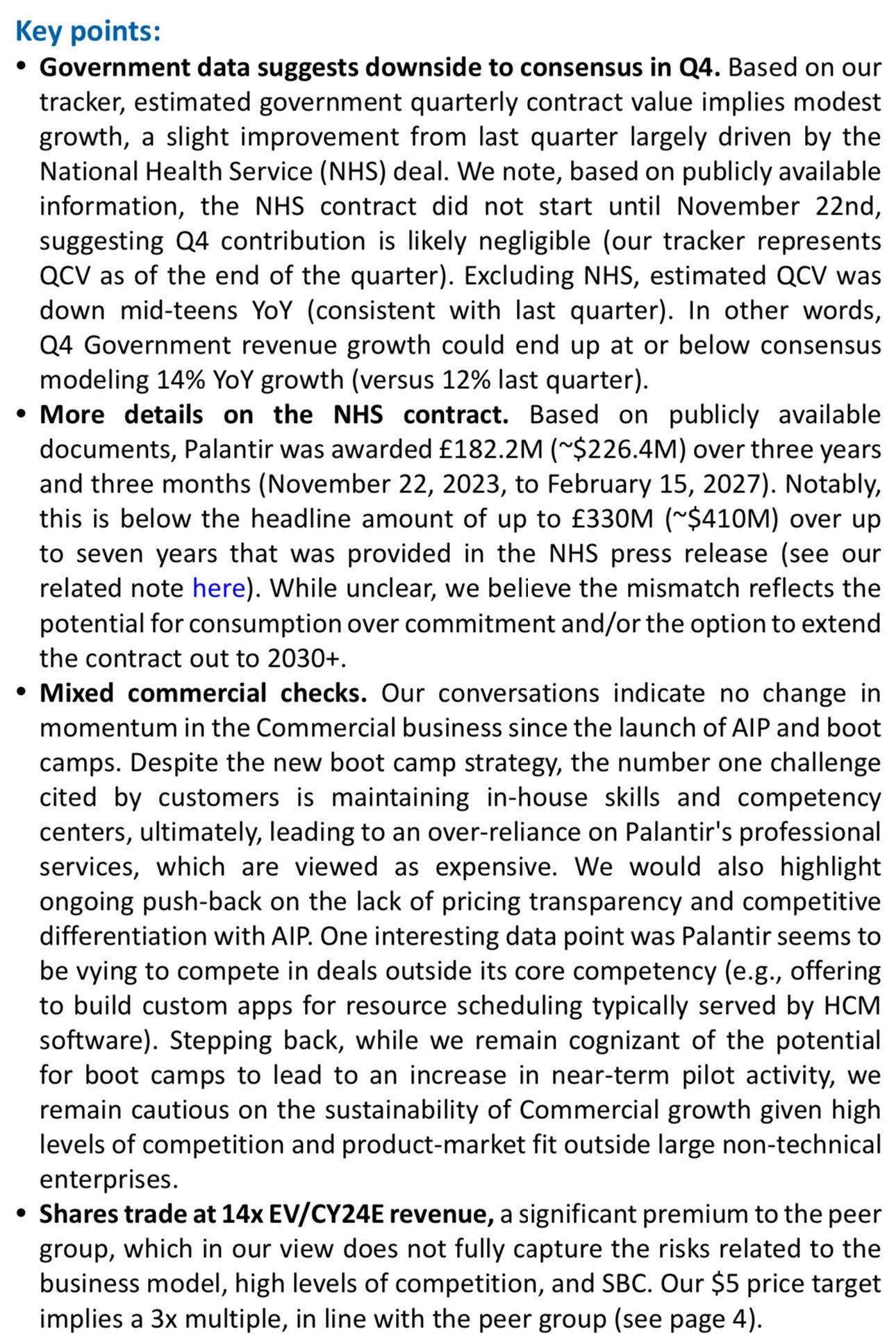

Here’s what both had to say, starting with RBC:

Second, here’s what Citi had to say:

Citi on $PLTR: "We are incrementally cautious into Palantir 4Q23 results as we believe an underwhelming federal deal activity Q (even w/NHS contract) should offset strength in U.S. commercial. Our revised FY24 estimates are 2 pts below consensus, and we see downside risk with shares trading at FY24 Ev/Sales of ~15x, for just teens top-line growth. We maintain Sell/High Risk and target price of $10."

So, both of their sell ratings come down to two things — slowing government growth and potential for AIP client conversion to not be high. Do both of those concerns warrant a $5 and $10 price target? In my opinion, respectfully, no.

The government business will be the part that I am most curious about going into earnings. It may slow down compared to a few years ago, but I don’t expect it to massively slow down QoQ.

If it does slow down a bit, then AIP customer conversions — leading to top line revenue growth — will be what subsidizes the slowdown in growth and gives us time to figure out the government business reaccelerating. RBC feels that AIP client conversion won’t be enough to offset the lack in government growth. We’ll see when we get the numbers, but if the bootcamp model success is any indication of customer conversion, I’d expect to see a decent level of topline growth and guidance independent of the government business growing in order to still deliver reasonable growth going into 2024.

It really comes down to if clients are converting easily from bootcamps into pilots and then into deals. Ted Mabrey, Head of Commercial, recently put out an article discussing how incredible bootcamps have been and why Palantir uniquely has been able to innovate in the SaaS go to market space by being product driven. Even if Q4 doesn’t show huge conversions form these bootcamps, if Palantir is seeing success from them (all indications publicly have pointed to bootcamps going very well), then we should see them guide for atleast 20% growth and eventually revise that to 25-30% by mid year.

RBC & Citi are basically saying we will grow in the mid teens. I don’t think that’s the case. If that’s not the case, and if the Coles Supermarket deal is any indication of what we think deals will look like for expanding AIP + Foundry across the world, then we should have a much stronger year of growth and make the $5 and $10 PT’s look…silly.

Thank you for reading — I’ll see you tomorrow in your inbox!