Welcome back to DailyPalantir! On today’s newsletter, we will preview Palantir’s upcoming earnings. I’ll be live tomorrow at 3:30PM EST on YouTube streaming the earnings conference call. Let’s get into it!

So, this is going to be one of the most important earnings calls for Palantir. The reason for this is because the stock is up 45% YTD, so expectations are heavy. Additionally, the stock was near $30 before the Nasdaq saw a 10% correction last week, so the core focus right now is on if companies are actually seeing the benefits of AI. Because Palantir provides the tools to make AI useful, it’s going to be a question on if Palantir can begin showing effective monetization of AI.

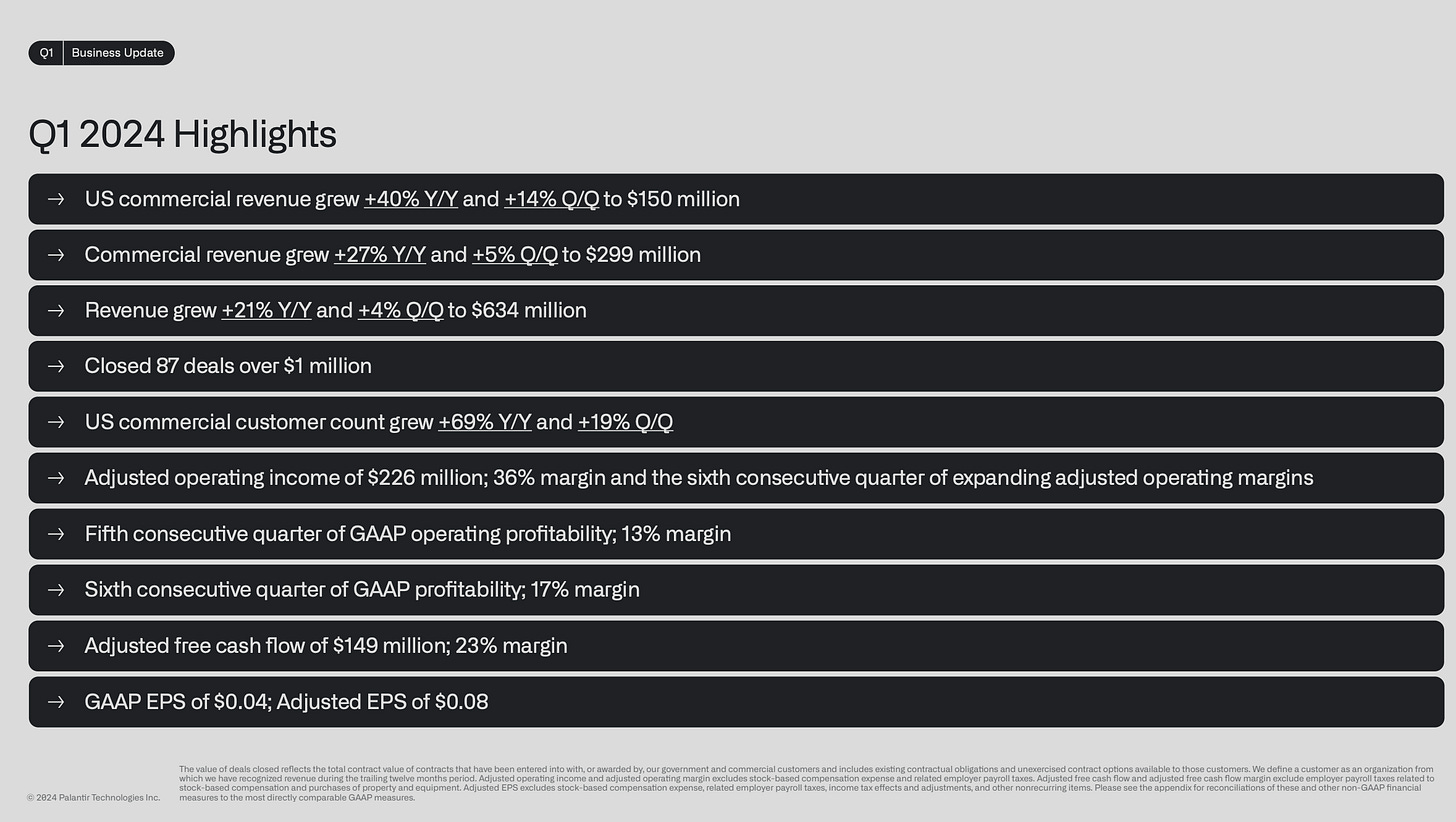

First, here were the highlights from Q1:

Overall:

US Commercial:

Alright, let’s get into Q2…

Revenue Growth

Analysts are hopeful for approximately 25% year-over-year revenue growth, which would be impressive considering the weak comparisons from Q2 2023. Last year’s Q2 performance was relatively subdued, making the 25% growth target attainable. To get to 25% growth, we would need $665M in revenues. Analysts are projecting about $650M, which would come in at 22% growth. This expected growth is largely driven by the US commercial sector, where Palantir has made significant progress. The favorable comparison from the previous year should make this quarter's growth appear particularly strong.

Despite the optimism, there is some caution regarding the government segment of Palantir's business, which may not contribute significantly to this quarter’s growth. Expectations are for government revenue to remain relatively flat, placing greater emphasis on the commercial sector to drive overall revenue. Nevertheless, strong performance in the US commercial sector would still represent a notable achievement.

Although the government business did reaccelerate last quarter to 16% YOY, largely driven by the US business, not sure if we are going to see that trend continue. US Commercial is what is going to lead the top line revenue growth to continue to gain momentum, but it’s going to be a question on how many customers Palantir was able to sign via their bootcamps and if those customers turned into actual deals in Q2.

Customer Count

Customer count is a key indicator of the company’s market penetration and adoption. This metric is going to be important in understanding the effectiveness of Palantir's AI-driven boot camps.

Projections suggest that Palantir could see a 42% year-over-year growth in total customer count, reaching around 600 customers. This would represent a notable increase, albeit slightly slower than previous quarters. The real emphasis, however, is on the growth within the US commercial sector, which has been a significant focus area for Palantir. The introduction of AI boot camps has accelerated customer acquisition, demonstrating the practical value of Palantir’s solutions.

Another important aspect is the international customer count, particularly in markets like Europe and Asia. While the US remains the primary driver of growth, expanding the customer base internationally is essential for diversification and tapping into new revenue streams. Recent contracts, such as those in Germany and Japan, highlight the potential for significant growth outside the US, but the overall impact on the customer count will be closely scrutinized.

Although I want to see an increase in international customer growth, it doesn’t seem like that is currently the focus. US Commercial customer count is going to be what drives much of the overall customer growth and should be strong enough to give the company time to eventually scale their go to market in the international arena. Here was the customer count growth from last quarter:

Rule of 40

The Rule of 40 is a metric used to gauge the health of a SaaS company by combining its revenue growth rate and profit margin. For Palantir, staying above the 40% threshold is a significant indicator of its financial robustness and operational efficiency.

In the previous quarter, Palantir managed to stay comfortably above the Rule of 40, largely due to its impressive free cash flow margins. This trend is expected to continue in Q2 2024, despite the challenging market conditions. The company's strategic initiatives, including its focus on high-margin AI-driven solutions and the effective use of boot camps to drive customer acquisition, have contributed to maintaining a strong Rule of 40 score.

The Rule of 40 also highlights Palantir’s ability to balance growth with profitability. While many SaaS companies might sacrifice profitability for rapid growth, Palantir has managed to achieve both. This dual capability is particularly noteworthy given the weak comps from the previous year, which make the current growth figures even more impressive. The company's efficient use of resources and focus on high-value contracts have played a significant role in this achievement.

Analysts are optimistic that Palantir will continue to post strong Rule of 40 numbers, bolstered by its growing customer base and high free cash flow margins. The expected revenue growth, combined with the company's disciplined approach to cost management, suggests that Palantir is well-positioned to sustain its performance. This balance of growth and profitability not only strengthens investor confidence but also sets a positive outlook for the company’s future.

Furthermore, the introduction of new AI capabilities and expansion into international markets are likely to enhance Palantir's Rule of 40 performance. These initiatives are expected to drive both top-line growth and improve operational efficiencies, thereby contributing to sustained profitability. The company's ability to innovate and adapt to market needs will be critical in maintaining its Rule of 40 metrics.

Why Rule of 40 matters

Palantir JUST began showing this slide in their Q1 earnings:

The Rule of 40 matters because it provides a comprehensive view of a SaaS company’s financial health. By considering both growth and profitability, it helps investors understand whether a company is scaling efficiently. A company that excels in the Rule of 40 is typically managing its resources well, investing in growth without sacrificing margins, and is likely to be a sustainable, long-term investment.

For Palantir, maintaining a strong Rule of 40 score is crucial as it signals to the market that the company is not only growing but doing so in a financially responsible manner. This balance reassures investors that Palantir is capable of generating value consistently, which is essential for long-term success. As the company continues to expand its offerings and enter new markets, adhering to the Rule of 40 will be a key indicator of its strategic effectiveness and operational health.

Final Thoughts

Overall, I’m expecting a solid quarter. I have no idea what the stock is going to do, but it has had a strong year. This is an earnings call for Palantir to justify the stock’s movement and continue to show that even if they aren’t fully living up the premium the street is giving them, they are moving in the direction where growth is increasing and therefore they are proving that the street is not wrong to be paying a high multiple for Palantir.

Going into earnings, we’ve seen multiple upgrades from firms like Jeffries and Citi to $28. Although both firms acknowledge in their notes that they feel $28 would be pricy, they believe there is enough momentum in commercial to justify the overall valuation and as a result have raised their price targets.

My thoughts on if the stock drops:

1/ If they aren't monetizing yet but customer count is increasing and the stock drops on that reason, it's a very easy buy the dip because we know what's coming in the future.

2/ If they begin monetizing and decently beat estimates but it's not enough for the street and the stock drops, then it's again an easy buy the dip because it would be a repeat of Q1 earnings.

In conclusion, I'm looking for increased US commercial, adjusted operating margins continuing to expand, and a slight full year guidance raise.

I’ll be live tomorrow — excited to cover another step in the journey and see you all there!

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!