PALANTIR'S SEPTEMBER: New Deals, Insider Selling, 4 Years of Being Public & +20% In The Stock.

Palantir wins some new partners and we discuss the implications of insider selling..

Welcome back to DailyPalantir! On today’s newsletter, we discuss the new deals Palantir got last week, their September recap and what has been going on with insider selling. Let’s get into it!

Palantir’s September

Palantir had some core events happen in September, including the biggest event in their company’s history: getting into the S&P 500.

The stock was trading around $29.50 the day they got in, went up 7% on the announcement, and then went on to go up 20% for the month. It was one of the most monumental events for a company that was never thought of as being able to get included into this index.

Additionally, Palantir hosted their 5th AIPCon and also signed a 5-year extension with one of their oldest commercial clients, BP.

Let’s get into some of the deals they won last week…

Nebraska Medicine and Palantir Announce Pioneering Partnership to Use AI Technology to Advance Healthcare

The new deal between Palantir Technologies and Nebraska Medicine, where Palantir's Artificial Intelligence Platform (AIP) is being used, is a big step forward for Palantir’s involvement in the healthcare sector.

This partnership is showing real progress by improving patient care and making hospital operations more efficient at Nebraska Medicine. The rapid deployment of over ten AIP applications within a year, enhancing patient throughput and expanding claims reimbursements, demonstrates how Palantir’s technology can effectively solve real, complex problems in healthcare settings.

This partnership is particularly beneficial for Palantir as it serves as a robust validation of its technology in a crucial industry like healthcare. The fact that Palantir’s tools have been successfully adapted to meet the complex demands of a hospital environment, improving processes such as patient discharges and supply chain management, makes a strong case for its application across other healthcare facilities. This success not only boosts Palantir’s credibility but also opens doors to new clients in the healthcare sector looking for technological solutions to enhance their operations.

Again, Palantir powers 20% of hospital beds in the United States. They just got a 7-year $50M extension with Tampa General Hospital. The healthcare vertical is one of the most exciting verticals for Palantir and can contribute to their accelerating growth.

Another example is Mount Sinai:

Palantir’s work with Nebraska Medicine is poised to drive even more innovations, especially as they utilize AIP. They plan to delve into new areas of clinical research and patient care, which could further solidify Palantir’s standing as a key player in healthcare technology.

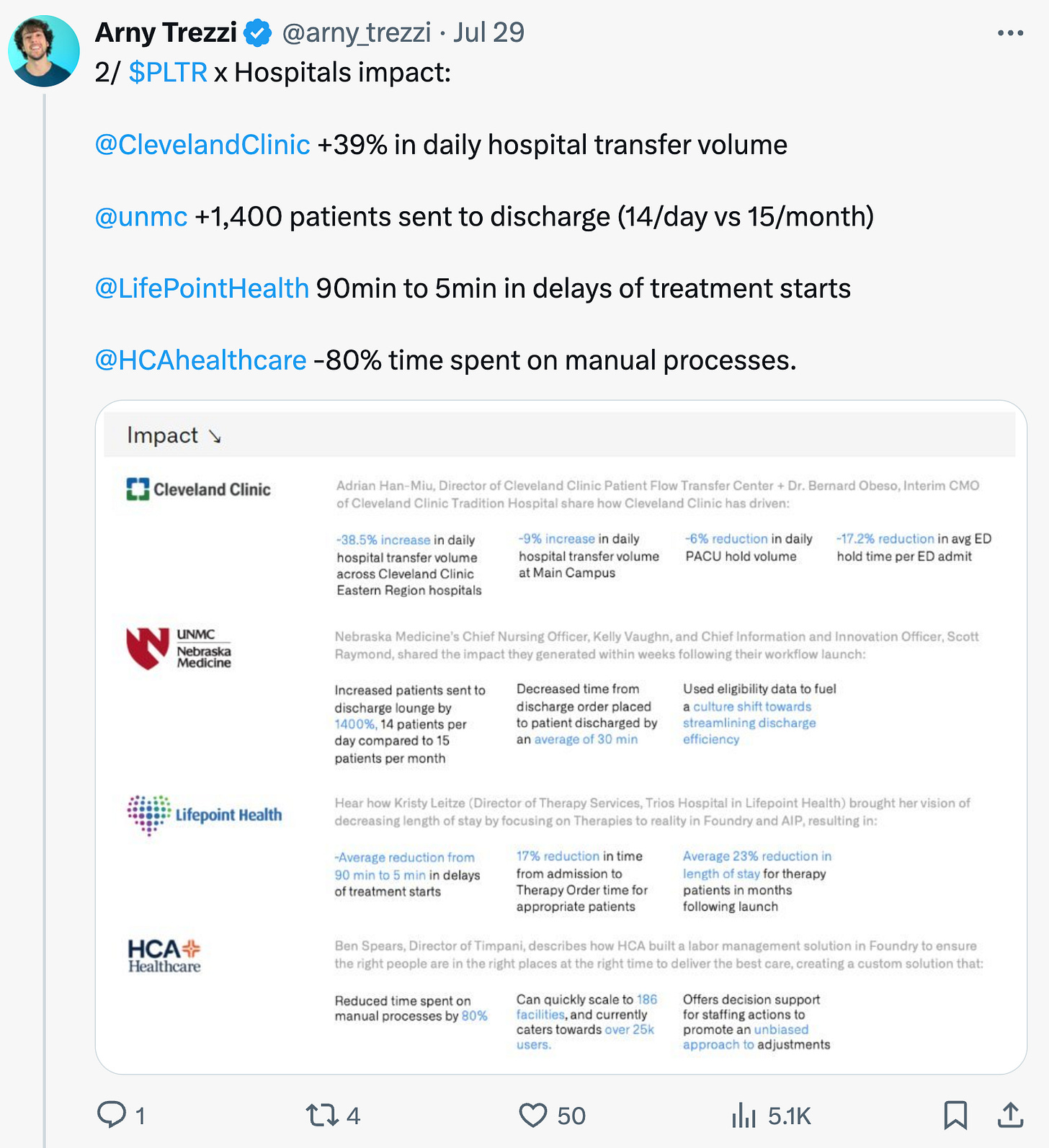

Other Palantir Healthcare examples:

By continuing to adapt and refine its offerings to meet the specific challenges of the healthcare industry, Palantir is setting itself up as a leading force in transforming traditional healthcare through modern technology.

APA Corporation Expands Partnership with Palantir To Leverage AI Technology Across Their Oil and Gas Operations

The recent announcement that Palantir Technologies has extended its partnership with APA Corporation marks a strategic development that highlights several important aspects of Palantir's business trajectory.

Firstly, the renewal and expansion of the contract with APA, a major player in the oil and gas industry, underscores Palantir's significant role in driving digital transformation within traditional sectors. By deploying its Artificial Intelligence Platform (AIP) across various operational domains such as planning, supply chain management, and maintenance, Palantir is not only expanding its presence in the energy sector but is also demonstrating the adaptability and effectiveness of its software solutions. This extension serves as a validation of Palantir's AIP as an essential tool for managing complex operations and optimizing performance, which could lead to increased trust and investment from other industry giants seeking similar technological enhancements.

What’s also important here is that Palantir JUST signed a 5-year extension with BP, one of the largest players in the oil and gas space. Being able to sign other companies in the vertical simply means their solution is scaleable and other people are finding value in it.

Secondly, the partnership highlights Palantir's capabilities in real-time data analytics and advanced algorithms, crucial for enhancing APA’s operational efficiency and cost management. This is important because it shows Palantir’s ability to directly influence the profitability and sustainability of its clients by enabling faster decision-making, improving reliability, and optimizing logistics. Oil companies want to become more efficient, especially when it comes to drilling. Success in these areas could enhance Palantir's market credibility and potentially lead to an expansion of its services across APA's global operations, which means an expansion of their relationship with AIP.

Finally, the collaboration aligns with Palantir’s mission to address significant global challenges, focusing on the responsible production of energy resources. By emphasizing efficiency and sustainability, Palantir is not only contributing to the economic aspects of its clients' businesses but also to broader environmental goals.

This strategic alignment with global sustainability objectives could open up new opportunities in sectors that are increasingly pressured by regulatory requirements and societal expectations to improve their environmental footprint, positioning Palantir at the forefront of the next wave of essential enterprise solutions in critical industries.

Insider Selling

So, Peter Thiel has sold about $600M of Palantir stock in the past week. Alex Karp has sold $325M of Palantir stock. This begs the question…if insiders are selling, what does that means for investors?

Here’s how I’m thinking about it:

1.) $PLTR is up 100%+ YTD. This is not because of memes or roaring kitty. This is because of execution. When a stock surges that much in a year, people take profits. If the stock was up based on pure speculation and no execution, that would be an insider cashing out to cash out. When the CEO takes everyone along for the ride (aka helps everyone get rich) due to winning more deals and reaccelerating growth, I have no problem with them taking profits.

2.) Karp has vested these shares for decades. He deserves to get liquid.

3.) These shares were exercised from stock options, which means he had to also sell to cover the taxes. With these types of capital gains, the taxes are heavy.

4.) If you hate him selling so much — you can also sell! But if you have 5000 shares compared to his 60M, it might not make sense given the allocation sizing that someone like Karp has towards Palantir vs. your stake.

5.) Finally, a sell at these levels is probably him saying that he thinks the stock is getting up there in valuation. Karp said a while back that sometimes the stock will be undervalued and overvalued, but he does believe the company can be 10 times bigger than it is now. If the market is willing to pay $80B for Palantir, he may think that valuation is stretched and is risk managing. There is NOTHING wrong with that and actually smart to do for a 56-year old who’s dedicated the last 25 years to Palantir. However, this also doesn’t mean the stock has to sell off on his selling if there is enough liquidity to absorb it, but it could also signal that the stock will consolidate here vs. pushing forward until the next set of catalysts.

Thiel is obviously signaling he feels shares may be stretched right now, but again he’s held since 2006 so you’d imagine he take profits after the stock goes up 100%+ in a year AND if you really hate him selling, you can sell as well. This isn’t a situation where insiders sell at the top and retail is holding the bag. The market is absorbing the sales so nicely that the stock is going up AFTER their sales leading to a better exit price for retail right now, which is pretty incredible. The amount of liquidity available for this stock is massive from the retail and institutional angle, especially now due to S&P inclusion. Overall, it seems like the market is starting to find their own way to justify Palantir’s valuation vs looking at what the insiders are doing.

My final 2 cents: this is not a big deal and quite frankly expected for someone who’s been at the company for 20+ years and had his stock go up 115% YTD. Anyone else in this situation would likely do the same and if you really hate the move, you can sell a portion of your position with Karp just like he is doing now.

Fun Fact: Palantir Went Public today, 4 years ago!

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!