Welcome back to DailyPalantir! On today’s newsletter, we dive into a new partnership Palantir extends with an existing client and a famous investor coming back into the company. Let’s get into ti!

Alright folks, a big investor is back into Palantir stock.

Here’s his fund buying:

Additionally, 229 Funds added Palantir for the first time (or after having completely existed the position previously) as per the latest 13F filings.

Top 5 funds that bought:

VOLORIDGE INVESTMENT MANAGEMENT, LLC --> 2,083,336 shares

GILDER GAGNON HOWE & COMPANY LLC --> 2,039,578 shares

YONG RONG (HK) ASSET MANAGEMENT LTD --> 1,595,700 shares

CAPITAL FUND MANAGEMENT S.A. --> 995,918 shares

DUQUESNE FAMILY OFFICE LLC (Stanley Druckenmiller) --> 769,965 shares

Why This Matters

Stanley Druckenmiller and Alex Karp have a very special relationship. Stanley was one of the original investors in the company and even hosted a 45 minute interview with Alex Karp. He compared Palantir to Apple and Steve Jobs in the interview for their ability to focus on creating products that unlock value which driver customers to them.

He then ended up selling at about $8 two years ago. Now, the reason he sold was actually not because he lost faith in Palantir, but it seemed he thought another opportunity was going to do much better, and he was right: Nvidia.

When Nvidia fell to the low $100s, while Palantir was in the $8 range, Druckenmiller essentially bet his firm on NVDA, along with Microsoft. Palantir stayed flat for about a year, but NVDA went on an incredible rally — the market began to understand how important AI was going to be as ChatGPT became mainstream. He saw the AI wave coming before many on Wall Street and he knew that the GPUs from NVDA were going to be crucial to anything and everything with AI.

Since then, he has begun cutting his position heavily. On cutting Nvidia, he said:

“We've had a hell of a run. A lot of what we recognized has become recognized by the marketplace now."

It is my opinion that he is now back into Palantir because he believes the marketplace has not recognized what is going on here. Yes, it’s less than 1% of his fund, but he is paying 2.5x what he paid 2 years ago to get back in.

Stanley is a big name. He is a legend on Wall Street. People watch the moves he makes and why he makes them. To have him back in the company is very, very important for more institutions to feel that Palantir has something the marketplace is not recognizing yet.

What I am now going to be looking out for when the next 13Fs are out is if he adds to his position. If he does, then he may be building a sizeable stake in the company. I’ll keep everyone updated, but it is really good to see one of the original investors who believed in the company back into Palantir.

Ringier Partnership

Palantir has just extended a partnership with Ringier, a Swiss Media company, for 5 years utilizing AIP/Foundry. PR below:

So, Palantir and Ringier began working together in 2018 and now the partnership will extend for another 5 years.

Why did they originally work together? They wanted to develope a newsroom tool that aggregated multiple data reports into a single platform. Previously, journalists at Blick.ch (Ringier's outlet) had access to an overwhelming number of data reports but lacked the means to effectively analyze them. The new tool developed by Palantir consolidates this information into actionable insights for journalists.

The idea was that if they could provide journalists with easy-to-use tools for accessing integrated data about their content's performance and audience preferences, they can tailor their reporting more effectively while maintaining editorial independence.

Some core points from their original partnership:

Palantir Foundry serves as the central platform integrating Ringier’s Content Management System (CMS) with traffic data from Blick website.

Customized dashboards are provided for journalists using an intuitive ontology including Articles, Publishers, Journalists or Videos.

Editorial teams can set quarterly targets using forecasting algorithms within Foundry which are monitored against actual performance.

The collaboration has led to increased traffic for Blick.ch which translates into additional revenue supporting independent journalism.

85% of the newsroom staff at Blick.ch uses Foundry daily indicating high adoption rates of the tool provided by Palantir.

Now, with this new partnership, implementing AIP across the organization is the goal.

I really liked seeing this deal. I actually made a video on this partnership back in 2021, and it was the first time I saw Palantir’s software being used in an industry like media — not energy, healthcare, supply chains, etc. It showed me the diversity of their software.

With Palanitr being able to get one of their first commercial clients onboarded onto AIP and also to use AIP for the next 5 years just shows me how valuable the relationships are that they have with their clients. It also shows that clients are getting value from Foundry but seeing the value they can continue to expand with when implementing AIP, proving the value of AIP to existing clients can be a catalyst for more deals getting done. We saw this in the Q1 deals closed numbers as well:

Institutional Ownership Rising

Institutional ownership continues to rise for Palantir as 13Fs have begun to come out. The one thing I am looking for as I see more institutions get into the stock is if we can begin to get the retail vs. institutional float to 50/50.

Currently, it’s 60% retail and 40% institutional. The main reason this matters is because the S&P 500 will be rebalancing agains twice this year, and one of the reasons I think Palantir might not be included in 2024 (if not this year, I do think 2025 it will happen) is because we have the second lowest institutional float of all 500 companies in the index.

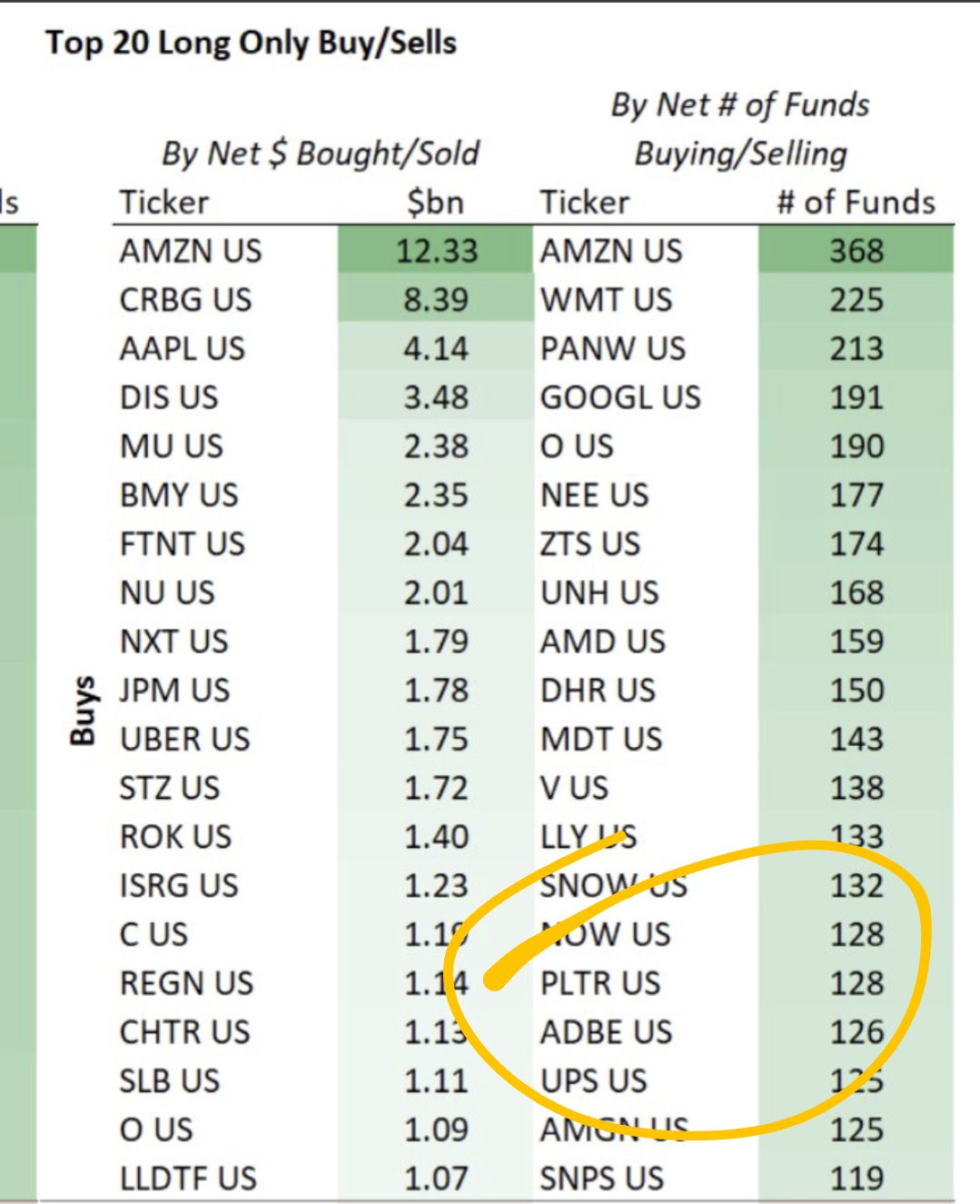

As a result, the committee overlooking the index may continue to avoid Palanitr as they feel the stock is too volatile due to the investor base. After all the buys/sells this quarter, 128 net funds added to Palantir.

We’ll need to continue to see an increase to this in order for the institutional float to continue rising, leading to better chances of being included in the index.

I also think we could join the index on a thematic perspective — if the S&P 500 wants more AI in the index, Palantir is one of the only profitable AI companies on the market (excluding the Mag 7). The GAAP profitability was key here — if the AI trend continues to be undeniable, and Palantir is the only one profitable at our size, it may also be a catalyst for us to join the index.

That’s it for today - see you tomorrow!

This newsletter will always be free and never have paywalled content. To support the newsletter, you can give a gift subscription below. Thank you for reading daily!

Party On With Amit, Druck and $PLTR. 🥳🥳🥳🥳🥳🥳🥳🥳🥳🥳🥳✌️✌️✌️✌️✌️