Welcome back to DailyPalantir! In today’s newsletter, we explore an explosive piece by the Times into how vital Palantir is to Ukraine, a new government prototype deal Palantir got, and look into Q1 expectations from Wall Street. Let’s get into it!

Palantir is Deeply Integrated in Ukraine

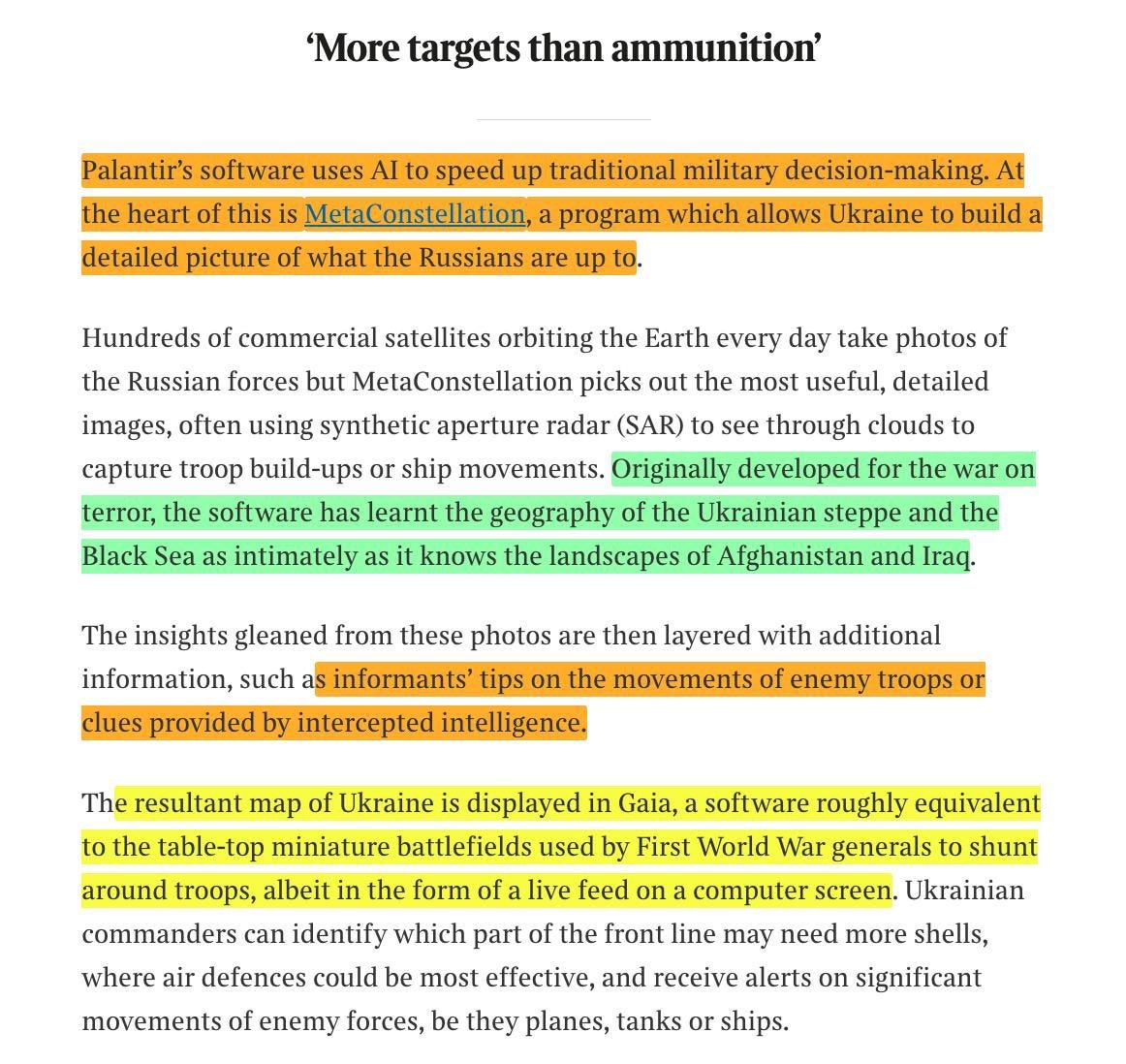

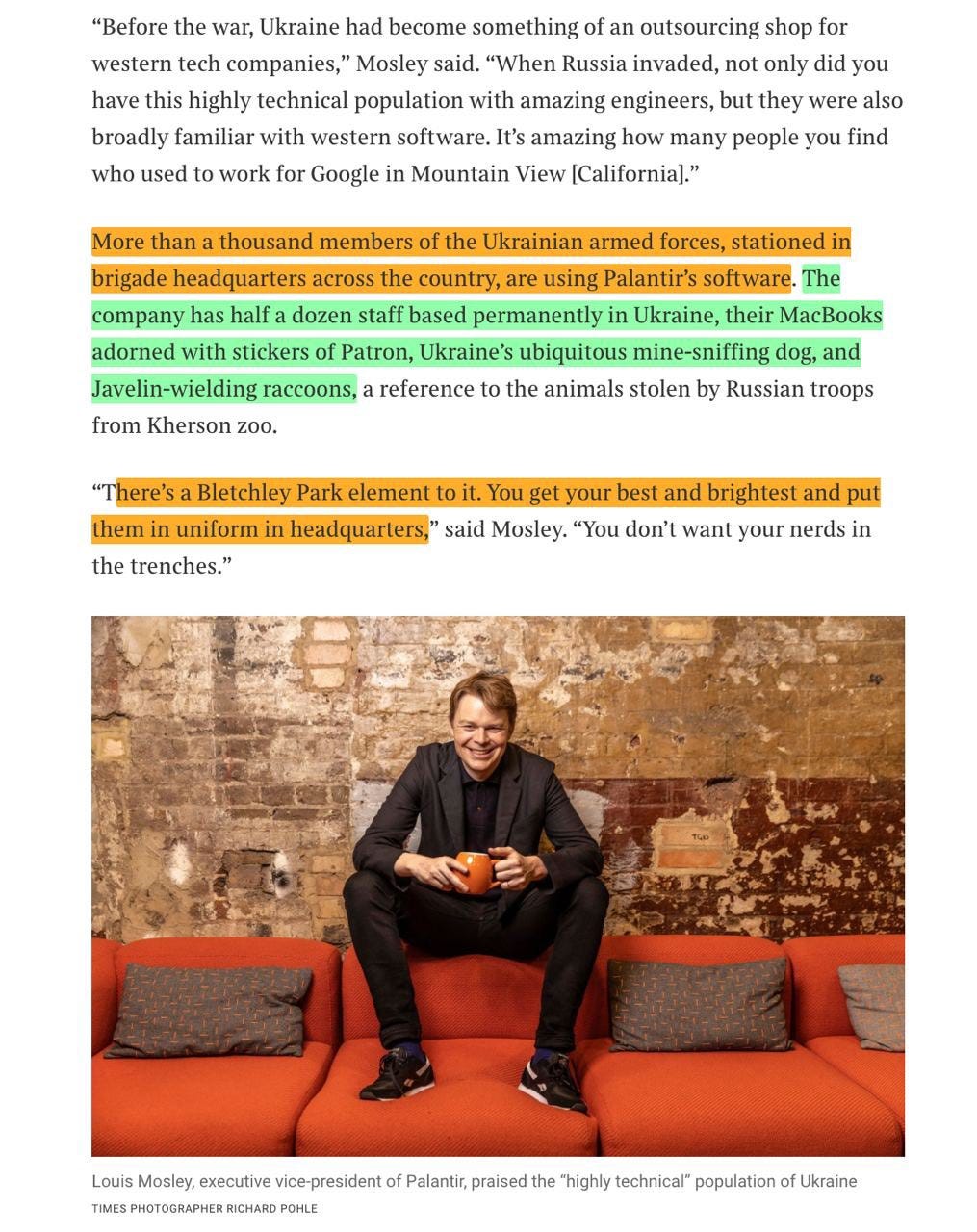

So, last week, an article from the Times was published about Palantir’s role in Ukraine. This was one of the deepest articles written about how Palantir is working in Ukraine and why the country continues to use their software. Some excerpts below shown by Arny on X:

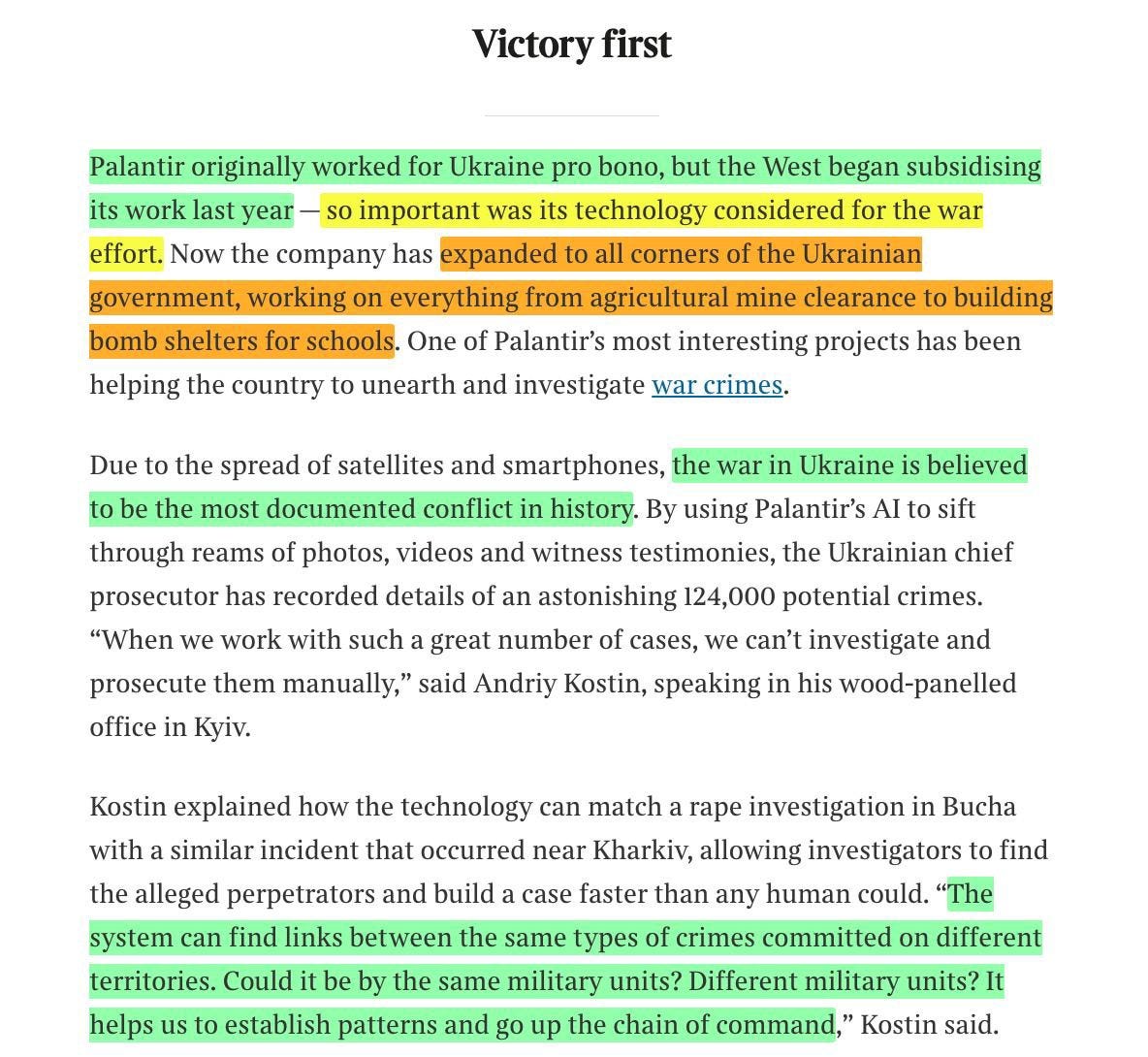

It seems Palantir is being used in Ukraine in even more ways than we all thought. We knew that on the battlefield, there were usecases. We also knew that Palantir’s software had some application in the rebuilding of schools/homes. But it seems the government themselves are finding different applications of their software and since Palantir just signed an extension for a decade to work with Ukraine, the usecases of the software across the country can grow as Palantir expands to continue doing more things for the country.

We saw this playbook with the NHS in the UK. Palantir came in, basically worked for free, was so good that the UK government had to pay them, and then ended up receiving HUGE contracts that only furthered their influence and importance in the region.

I believe the same is happening here in Ukraine. This article also affirms the deal we saw last week, which was an extension to work to rebuild Ukraine through the Ministry of Defense until 2033.

If we can become the modern operating system of Ukraine, I would argue that MANY other NATO countries come into play. We saw last week that Germany is now asking for Palantir again, we got another contract with Lithuania — the question to me now becomes when more NATO countries get Palantir, which will really depend on either how much Alex Karp wants to persuade these companies to take his software seriously or how bad of a situation the country gets into.

New Palantir Defense Prototype

Palantir got a new defense prototyping contract last week. From the PR:

The U.S. Army has partnered with the Defense Innovation Unit (DIU) to prototype autonomous software and processes to adapt uncrewed vehicle technology to a range of diverse and challenging military environments. The Ground Vehicle Autonomous Pathways (GVAP) project will prototype software for the navigation of uncrewed vehicles by fusing data from multiple sensors and allow for teleoperations of unmanned ground vehicles (UGV). Additionally, the project will provide a technical pipeline to continue rapid modeling, testing, evaluation, development, and deployment of autonomous features as they become commercially-available.

“There has been a revolution in the techniques and capabilities of uncrewed ground vehicles occurring in the private sector over the past two decades,” said Dr. Kevin O’Brien, Technical Director for DIU’s Autonomy Portfolio. “We’re eager to bring these matured technologies back into the Department of Defense, where initial work was inspired by the DARPA Grand Challenges.”

DIU received 110 responses spread across two GVAP solicitations. In each, a panel of DoD subject matter experts facilitated a rigorous and competitive Commercial Solutions Opening (CSO) down-select process, resulting in the selection of four autonomous navigation vendors (Forterra, Kodiak Robotics, Neya Systems, Overland AI), two machine learning and autonomy pipeline vendors (Applied Intuition Inc. and Scale AI), and two software system integrators (Anduril Industries and Palantir Technologies). Together, these companies will support the Army’s Robotic Combat Vehicle (RCV) program in developing a robust, capable, and compliant software system that can operate in a variety of autonomous modes and rapidly integrate a variety of payloads as they become available.

“We are excited to work with these best-in-class autonomy providers, software experts, and systems integrators as we drive towards merging software capabilities developed through the RCV Software Acquisition Pathway (SWP) into the RCV Full System Prototype (FSP),” said Steve Herrick, RCV Product Manager. “Our software system integrators will also be the first to implement Traceability, Observability, Replaceability, and automated Consumption (TORC) compliance for Army software-centric ground vehicles, thereby helping the Army ensure programmatic flexibility and performance over time.”

So, this deal was interesting to see because it feels very similar to how Palantir initially got the prototype for the TITAN contract back in June of 2022. The two software system integrators included in this deal are Anduril and Palantir — at first glance, it seems like they may be competing with each other, but it looks like to me that they instead are working with each other to build the best integration of software for the Ground Vehicle Autonomous Pathway.

What this further goes to show is just how much money the US is willing to spend on AI. Palantir just received a TITAN contract from $200M, which is a small part of the overall $1.5B they likely would receive over the next 5 years if the first version of TITAN goes well. One of the bull cases for Palantir is that they simply have a huge opportunity to capture when it comes to the government — we talked above about how large the NATO opportunity is, when you mix that with the potential in the United States Government business alone, it can get very large over the next few years if Palantir can manage to get these deals.

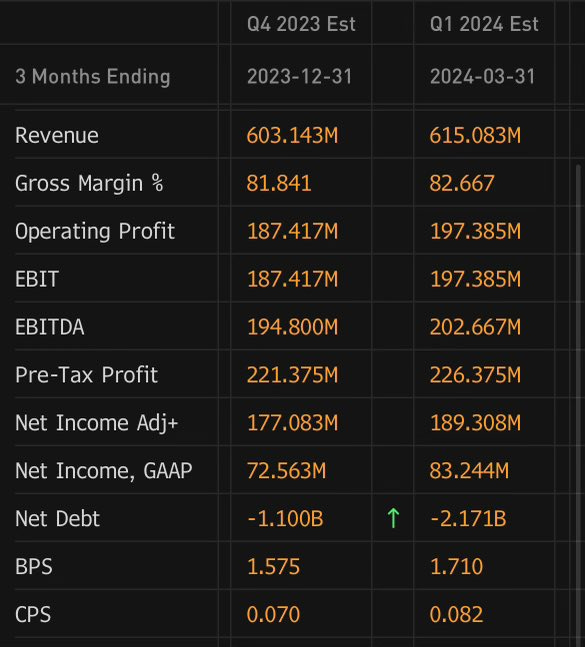

Q1 Wall Street Expectations

This was posted on X about Palantir’s Q1 expectations from Wall Street going into earnings.

All the numbers are pretty much in line with what management has said and what we should expect as shareholders. However, I do think it is possible for us to beat on the topline when it comes to revenue if one metric increases faster than most of us are expecting: customer count.

Palantir's topline revenue growth is closely tied to its customer count because each new customer represents an additional source of revenue for the company. As Palantir secures more clients, especially for its platforms like Foundry/Gotham/AIP/Apollo, it increases the number of subscriptions or licenses for its software, which directly contributes to higher sales figures.

Moreover, as Palantir's customer base grows, it benefits from network effects. More users on the platform can lead to more data being processed and shared, which in turn can enhance the platform's capabilities and value. This increased value can attract even more customers, creating a positive feedback loop that further drives revenue growth.

Additionally, new customers can lead to upselling opportunities. Once a client is onboarded and starts realizing the benefits of Palantir's software, they may be inclined to expand their use of the platform, purchase additional modules, or extend their service to other parts of their organization. This expansion within existing customer accounts can significantly boost Palantir's topline revenue.

Outside of customer count, if we see adjustments in operating margins, we may also see increases in net income — but they would be slight. The key here is to see numbers regarding bootcamps and projections for how those bootcamps can scale, which will give an indication around revenue growth, and in turn help us see if the business can beat projections for expectations on revenue.

Thank you for reading — I’ll see you tomorrow in your inbox!