The NHS Deal Is Coming Up

Palantir is in the running to win a 5-Year contract by the UK's NHS for a new federated data platform - the goal of the platform being to completely digitally transform the NHS and put an end to the backlogs, long wait times, and overall inefficiencies citizens in the UK have dealt with for the past decade.

Most people, including major critics of Palantir, expect the company to land the deal off the sheer fact that no other viable competitors have come into the mix and shown their ability to execute on high level tasks for the NHS. Palantir has various times over the past 2 years, including during the pandemic. But -- what would happen if they didn't get the deal?

First, it's important to understand why Palantir wouldn't get the deal. There are two reasons:

a.) The propaganda in the UK would officially get to Rishi Sunak, the PM, and he would cave. There are various media outlets in the UK funded by billionaires who have political agendas against Palantir because of their belief around Palantir being an evil-spy company that wants to exploit data. As a result, they have been spewing propaganda for the past year persuaded UK officials to no go with Palantir.

One would hope UK officials can do their own due diligence vs forming their impressions off media headlines, but nonetheless, the pressure may be too strong, and Rishi Sunak may decide to just not deal with the backlash.

b.) The NHS may decide to split the contract. This would mean that a multitude of companies get parts of the $611M deal vs. just giving it to Palantir so they can show to the UK press that they aren't fully reliant on one company. While the idea about not being reliant on one company may make sense, there is a thing as too many cooks in the kitchen.

If the past 20 years hasn't solved the problem, where the NHS experiments with various IT organizations, why would the next 20 years be so different? The beauty of Palantir is having all of your data centralized within an ontology to derive insights and efficiencies from -- this simply cannot happen if there are 5 different platforms all intersecting into one.

At that point there is no federated data platform, there are a bunch of companies trying to do their own thing and wasting the UK taxpayer's money to have a ridiculous experiment that won't work.

So, that's why Palantir wouldn't get the deal. What happens to the company if they don't land it?

1.] Not much -- there are many other catalysts to look forward to including the TITAN contract, S&P 500 inclusion, and increased on-ramp of AIP clients leading to monetization by H2 24'. One contract would not define Palantir.

2.] The NHS will continue to be screwed and Rishi Sunak, who has self proclaimed to be a techno-optimist, will have given up the one opportunity he has to embrace technology in the most profound of circumstances. Helping ALL people regardless of income and guaranteeing them healthcare is a noble cause, but if you disrupt the free market from creating efficiencies and forcefully allow the state to intervene, the ONLY way to maximize the greater good without privatization is by embracing technology that can make up for the lack of market forces.

Palantir. Is. That. Technology. How incredible is it for us to live in a time where a socialized system may ACTUALLY work because of technology, and the country trying to implement that system at scale disregards that technology AND market forces.

You can't have your cake and eat it too...socialism usually isn't the most effective, and if Palantir can make it somehow work by hiding the inefficiencies via technology and you choose to forgo it because of politics...good luck.

3.] Here's my stretch scenario: Palantir will find another socialized healthcare system in Europe and bid to be their modern operating system. It will be a much smaller deal, but Palantir will show what it means to have an entire country's healthcare run on the correct operating system and prove they should have won the NHS contract. When the NHS eventually fails, they may come back to Palantir. The price will be higher when that happens.

Cathie’s Back

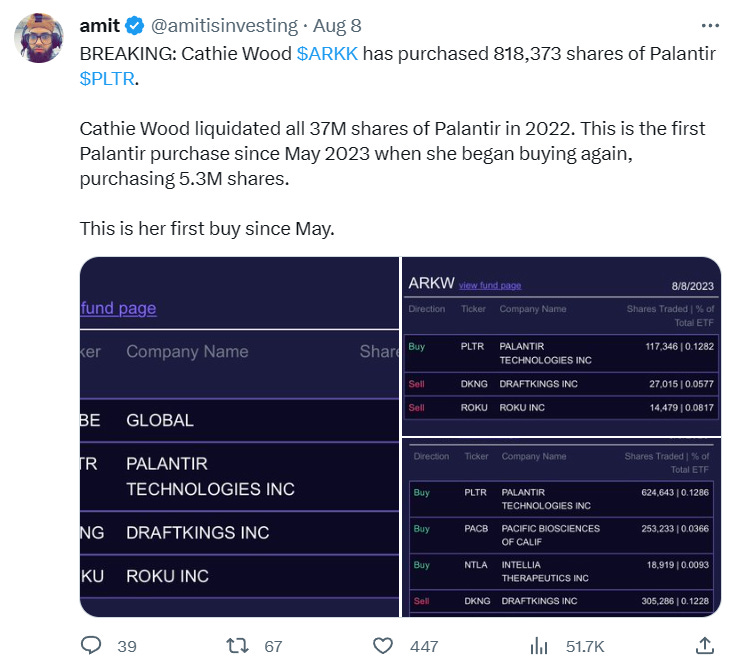

I didn’t get to report on this last week - but Cathie Wood is once again buying share of Palantir. She made two buys: one for 818K shares, and another for 123K shares the day after. Why I think Cathie $ARKK is back in $PLTR after Q2 earnings:

- company authorizes $1B in share buybacks signaling to the market they believe these prices are cheap

- now just 1 quarter away from S&P 500 inclusion

- 400 clients in the pipeline for flagship AI product, if they get even $2M/yr off each off those clients, it’s an additional $800M in ARR (BP will pay a lot more than $2M) - Dan Ives upgraded it to $25 + Raymond James to $22 = more of the street beginning to feel these prices could consolidate

- Cathie was sitting on 5.3M shares at $9, so averaging up to ~$12 may have seemed like a no brainer given she’d still be up on the position

- $ARKK believes AI is the largest opportunity over the next decade, makes sense to develop some type of Palantir position if they truly do become 1 of a handful AI monopolies over the next decade

Here’s my full analysis on why she is buying.

The Best Answer Alex Karp Gave During Q2 Earnings

The Hero of Palantir's Earnings Call

During the latest earnings call for data-analytics giant Palantir, all eyes were on Bank of America analyst Mariana. Facing technical issues in the last two quarters, her ability to ask her questions was hampered. But this time, her question stood out, not for its complexity, but for its focus: the qualitative insights of Palantir's shareholder letter.

The letter revealed a significant nugget of information - a whopping 100 organizations are currently using Palantir's Artifical Intelligence Platform (AIP), with another 300 in active discussions to get onboard. What's astonishing is that these figures translate to a pipeline of 400 potential customers - none of whom, according to available data, have been monetized by Palantir in the context of AIP.

If one were to make a modest estimate, assuming each of these 400 customers contributes an average of $2 million annually, that’s an additional $800 million in annual recurring revenue (ARR). And remember, some big-ticket clients could be paying much more.

Generative AI: The Competitive Landscape

Introduced just rcently, AIP is the latest in Palantir’s suite of products. It's fascinating that amidst a crowded field of competitors each claiming superior generative AI capabilities, Palantir boasts a potential 400 customers in line for its offering. The truly insightful moment of the call was CEO Alex Karp on why AIP isn’t just a new product for Palantir, but potentially its future.

Mariana's pointed question also touched upon how AIP integrates with Foundry, Palantir's flagship product. The nuance here is crucial: Foundry acts as an ontology for data, while AIP provides the semantic layer on top. The symbiotic relationship means that if you have Foundry, plugging in AIP offers a seamless, structured view of data.

However, it was quickly clarified that Foundry isn't a prerequisite. The product strategy for AIP ensures that it can function without Foundry, Gotham, or Apollo, catering to clients who might not need the full suite of products.

Teaching Customers: A Unique Strategy

Another distinctive characteristic of Palantir’s approach, emphasized by Karp, is its educational component. He drew parallels between Palantir’s first product, which addressed a niche market in clandestine services, and AIP. Both products, in his view, are not just solutions to existing problems; they're teaching tools, illuminating potential issues clients might not even know they have.

When clients understand the challenges they face and the tangible benefits of the solution, it builds product loyalty and allows Palantir a significant amount of pricing power.

The Waiting Game

Concluding the call, Karp confidently addressed Palantir’s monetization strategy – or the lack of an immediate one. First, they're introducing the market to a powerful solution without an upfront cost. Once organizations realize its intrinsic value, Palantir will be in a commanding position to monetize, armed with a product its users can't do without.

In essence, Palantir’s play with AIP is clear: enlighten the market, showcase the platform's capabilities, and, when the time is right, monetize a product that has become indispensable to its users. The success of this strategy remains to be seen, but for now, Palantir has certainly grabbed the industry's attention.

Dan Ives Twitter Spaces

Arny & I had a 45-minute discussion with Dan Ives on his $25 Palantir Price target last Friday - over 8,000 people tuned in on Twitter. You can catch the replay here.

That’s it for today - see you tomorrow! This newsletter will always be free and not have paywalled content. To support the newsletter, you can either give a gift subscription or subscribe to my Patreon for $1 a month. See you tomorrow!